Scarica l'app

-

- Piattaforme di trading

- App PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Condizioni di Trading

- Tipi di Account

- Spread, Costi e Swap

- Depositi e Prelievi

- Tariffe e spese

- Orari di Trading

Scarica l'app

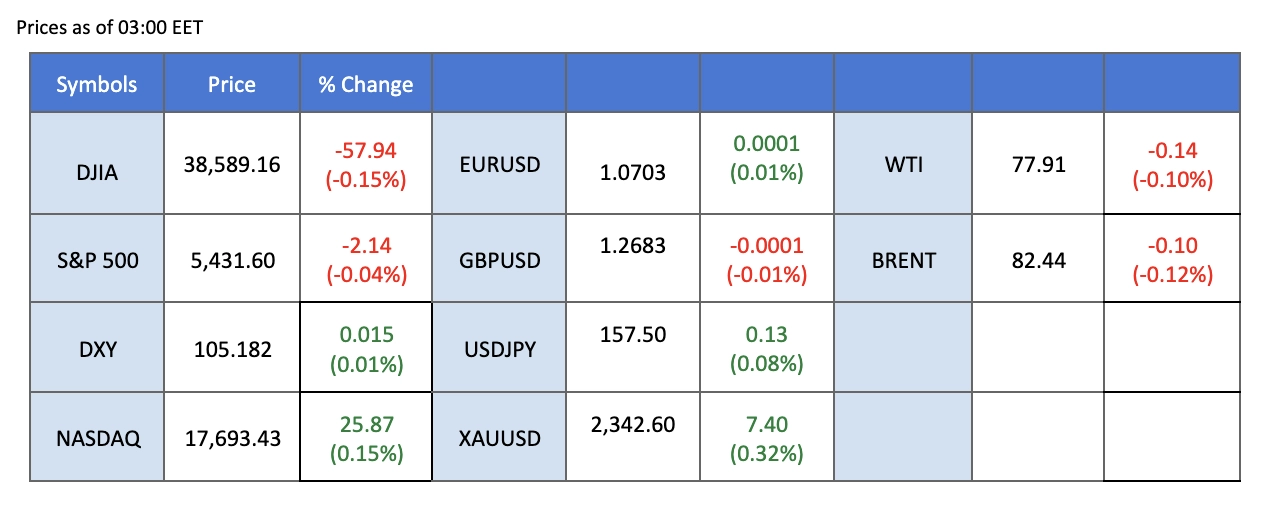

The Dollar Index experienced a slight rebound as investors processed hawkish comments from Federal Reserve officials, particularly Minneapolis Fed President Neel Kashkari’s suggestion to delay rate cuts until December. This shift in sentiment strengthened the dollar, influencing various markets.

Crude oil prices retraced from two-week highs as investors took profits amidst market uncertainties. Optimistic forecasts from OPEC and the IEA regarding oil demand were overshadowed by global economic concerns and the potential impact of future Fed rate decisions.

The Japanese Yen continued to sell off following the Bank of Japan’s decision to keep interest rates unchanged, which disappointed traders anticipating a rate cut. In contrast, the Nasdaq maintained a positive long-term outlook despite limited recent gains due to hawkish Fed remarks and rising Treasury yields, buoyed by ongoing enthusiasm for Artificial Intelligence and strong performances in tech shares like Adobe.

Current rate hike bets on 12nd June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (99.4%) VS -25 bps (0.6%)

(MT4 System Time)

N/A

Source: MQL5

DOLLAR_INDX, H4

The Dollar Index, which measures the dollar against a basket of six major currencies, saw a slight rebound as investors digested hawkish comments from Federal Reserve officials. Minneapolis Federal Reserve President Neel Kashkari stated on Sunday that it remains reasonable for the Fed to delay interest rate cuts until December, pending additional economic data. He emphasised that the US economy continues to outperform other nations that are cutting rates. Investors will be closely watching US Retail Sales data this week for further trading signals.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 63, suggesting the index might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 105.65, 106.35

Support level: 105.15, 104.45

Gold prices are consolidating within a range due to mixed market sentiment regarding the global economic outlook. On the bullish side, recent US economic data has generally underperformed expectations, with inflation easing significantly, leading some market participants to anticipate a Fed rate cut. Concurrently, other major central banks, including the ECB and BoE, have indicated intentions to ease monetary policies, typically a supportive factor for gold. However, recent hawkish statements from the Fed have driven up US Treasury yields and the dollar, capping gold’s gains.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 55, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 2330.00, 2360.00

Support level: 2295.00, 2265.00

The Pound Sterling experienced a sharp retreat ahead of the Bank of England’s monetary policy decisions later this week. Despite expectations that the BoE will keep interest rates unchanged, market participants foresee a 40% chance of rate cuts in the August quarter and a 70% likelihood in September. The UK is also set to release strong inflation data this week, with the consumer price index expected to fall to the BoE’s 2% target. Anticipation of rate cuts and easing inflation has dampened demand for the Pound.

GBP/USD is trading lower following the prior breakout below the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 34, suggesting the pair might enter oversold territory.

Resistance level: 1.2685, 1.2740

Support level: 1.2645, 1.2600

The EUR/USD pair continues to follow a bearish trend, largely driven by the appreciating US Dollar and a lack of significant market catalysts from Europe. Looking ahead, market participants will focus on Eurozone inflation data and statements from European Central Bank officials, including President Christine Lagarde and Chief Economist Philip Lane, for further trading signals.

EUR/USD is trading lower following the prior breakout below the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 34, suggesting the pair might experience technical correction since the RSI entered the oversold territory.

Resistance level: 1.0735, 1.0805

Support level: 1.0660, 1.0615

Recent hawkish statements from the Fed and rising US Treasury yields have limited the gains of the Nasdaq. Nonetheless, the long-term outlook for this tech-heavy index remains positive, buoyed by the ongoing hype around Artificial Intelligence (AI). The Nasdaq achieved its fifth consecutive record high on Friday, driven by significant gains in technology shares, including Adobe.

Nasdaq is trading flat while currently near the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 77, suggesting the index might enter overbought territory.

Resistance level: 19790.00, 20000.00

Support level: 19205.00, 18745.00

The Japanese Yen continues to face selling pressure as the Bank of Japan’s monetary policy decisions disappoint traders. The BoJ maintained its interest rates at 0% during its June policy meeting, contrary to some investors’ expectations of a rate cut. The announcement to reduce bond purchases, with final confirmation expected at the next policy meeting, has added to market uncertainties, further weakening the Yen.

USD/JPY is trading higher following the prior rebound from the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 56, suggesting the pair might experience technical correction since the RSI retreated from overbought territory.

Resistance level: 158.45, 159.50

Support level: 157.05, 156.10

Crude oil prices pulled back from strong resistance levels after reaching two-week highs, as investors took profits amid market uncertainties. On a positive note, the Organization of Petroleum Exporting Countries (OPEC) and the International Energy Agency (IEA) have maintained optimistic forecasts for oil demand. Nevertheless, concerns about the global economic outlook persist, particularly regarding potential Fed rate decisions. Investors will also focus on upcoming economic data from China, a major oil importer, to gauge future demand.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum,while RSI is at 49, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 79.80, 83.95

Support level: 76.15, 72.90

Scambia forex, indici, Metalli e altro ancora a spread bassi e con un'esecuzione fulminea.

Registrati per un Conto Reale PU Prime con la nostra semplice procedura.

Finanzia senza fatica il tuo conto con un'ampia gamma di canali e valute accettate.

Accedi a centinaia di strumenti a condizioni di trading leader del mercato.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!