Scarica l'app

-

- Piattaforme di trading

- App PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Condizioni di Trading

- Tipi di Account

- Spread, Costi e Swap

- Depositi e Prelievi

- Tariffe e spese

- Orari di Trading

Scarica l'app

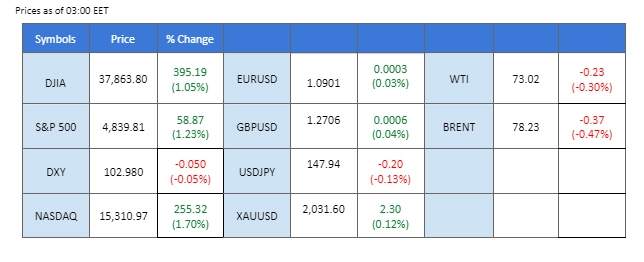

The market is dominated by speculation regarding an early rate cut by the Federal Reserve, leading to record highs in U.S. equity markets. Despite a recent slide in the dollar following its bullish run last week, some market strategists caution that the upbeat U.S. economic data suggests a prolonged period of elevated interest rates. In Asia, all eyes are on the Bank of Japan (BoJ), which is expected to announce its interest rate decision on tomorrow (23rd Jan), accompanied by the BoJ monetary policy statement. Anticipation is high that the Japanese central bank may maintain its ultra-loose monetary policy for an extended period due to challenges in sustaining inflation and wage growth in the country. Meanwhile, oil prices encountered robust resistance around the $74 level. Additionally, concerns about tension in the Red Sea were tempered by Libya restarting oil production from its largest field, impacting the overall supply-demand dynamics in the oil market.

Current rate hike bets on 31 January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98%) VS -25 bps (2%)

(MT4 System Time)

Source: MQL5

The Dollar Index experienced a marginal decline attributed to a technical correction, despite being poised for a weekly gain. The diminishing expectations for a Federal Reserve rate cut contributed to this shift, with recent positive economic data and hawkish comments from Fed officials boosting US Treasury yields. Anticipation of a rate cut diminished as US Treasury yields rebounded, supported by better-than-expected economic data and hawkish remarks from Federal Reserve officials.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 59, suggesting the index might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 103.40, 104.30

Support level: 102.55, 101.90

Gold prices initially surged but retreated as investors considered taking profits amid uncertainties regarding the Federal Reserve’s stance on rate cuts. While geopolitical tensions in the Middle East and other global conflicts support a bullish outlook, the influence of Fed’s hawkish tones and robust economic data continues to temper the short-term bullish sentiment in the gold market.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 53, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 2035.00, 2055.00

Support level: 2015.00, 1985.00

The Pound Sterling remains on a bullish trajectory against the U.S. dollar, with the GBP/USD pair approaching its next resistance level at 1.2729. Ongoing speculation regarding an early Federal Reserve rate cut persists, impacting the strength of the U.S. dollar. In contrast, the Pound Sterling receives support from robust CPI readings in the UK, fostering expectations of a sustained hawkish stance from the Bank of England (BoE).

The GBP/USD pair continues to trade in an uptrend trajectory, suggesting a bullish bias for the pair. The RSI is gradually gaining while the MACD is on the brink of breaking above the zero line, suggesting the pair is trading in bullish momentum.

Resistance level: 1.2729, 1.2815

Support level: 1.2630, 1.2528

The EUR/USD pair secured marginal gains last Friday as the U.S. dollar experienced a pullback in its recent bullish momentum. The dollar’s resilience waned amid a market sentiment shift, driven by speculation surrounding a potential dovish pivot from the Federal Reserve. Investors are turning their attention to the European Central Bank (ECB), which is set to announce its interest rate decision this Thursday. Expectations lean toward a dovish stance from the ECB, influenced by signs of easing in the region’s Consumer Price Index (CPI).

The EUR/USD pair breaks above its downtrend resistance level, suggesting a bullish bias for the pair. While the MACD is on the brink of breaking above the zero line, the RSI is gaining while the bullish momentum is building.

Resistance level: 1.0954, 1.1041

Support level: 1.0866, 1.0775

The USD/JPY pair maintained a sideways trajectory, hovering near its monthly high, as investors braced for a pivotal Bank of Japan (BoJ) interest rate decision scheduled for tomorrow (23rd Jan). The Japanese inflation rate and wage growth have shown signs of stagnation, leaving the central bank cautious about implementing a monetary policy shift. Persistent dovish expectations regarding the BoJ’s stance have contributed to the weakening of the Japanese Yen. All eyes are now on the upcoming BoJ decision, with market participants closely monitoring any indications or shifts in the central bank’s monetary policy.

USD/JPY traded sideways at its elevated level ahead of the crucial event. The RSI has dropped out of the overbought zone while the MACD has crossed on the above, suggesting the bullish momentum has drastically eased.

Resistance level: 148.88, 151.83

Support level: 146.90 145.35

The New Zealand dollar (NZD) has experienced a period of sideways trading following a recent bearish trend, signalling a potential trend reversal against the U.S. dollar (USD). The USD witnessed a bullish run propelled by upbeat economic data, leading to a decline in the NZD/USD pair. Market participants are closely monitoring the upcoming New Zealand Consumer Price Index (CPI) reading scheduled for Wednesday, January 24, 2024. This economic indicator is anticipated to influence the pair’s price movement, and investors should stay informed about potential developments.

BTC has broken below its uptrend support level, suggesting a bearish bias for the cryptocurrency. The RSI is on the brink of falling into the oversold zone while the MACD continues to flow below the zero line, suggesting BTC is trading with strong bearish momentum.

Resistance level: 0.6147, 0.6209

Support level: 0.6080, 0.6017

The US equity market extended its gains, propelled by a series of positive economic indicators. The Nasdaq Composite particularly stood out, surging over 1% as tech companies like Fastenal, KLA Corp, and ASML Holding reported financial results surpassing Wall Street estimates. The upbeat performance of these tech-heavy companies contributed to the overall positive sentiment in the US equity market.

The Dow is trading higher while currently nearby the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 66, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 37850.00, 39275.00

Support level: 36735.00, 35950.00

Despite a technical correction lowering oil prices after hitting resistance, the week concluded with a net gain. Middle East tensions and concerns about oil output disruptions, coupled with the International Energy Agency raising its 2024 global demand forecast for oil, provided a bullish backdrop. However, lingering uncertainties in the global economic outlook remained a focal point for investors.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 50, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 74.00, 78.65

Support level: 70.25, 67.40

Scambia forex, indici, Metalli e altro ancora a spread bassi e con un'esecuzione fulminea.

Registrati per un Conto Reale PU Prime con la nostra semplice procedura.

Finanzia senza fatica il tuo conto con un'ampia gamma di canali e valute accettate.

Accedi a centinaia di strumenti a condizioni di trading leader del mercato.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!