Scarica l'app

-

- Piattaforme di trading

- App PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Condizioni di Trading

- Tipi di Account

- Spread, Costi e Swap

- Depositi e Prelievi

- Tariffe e spese

- Orari di Trading

Scarica l'app

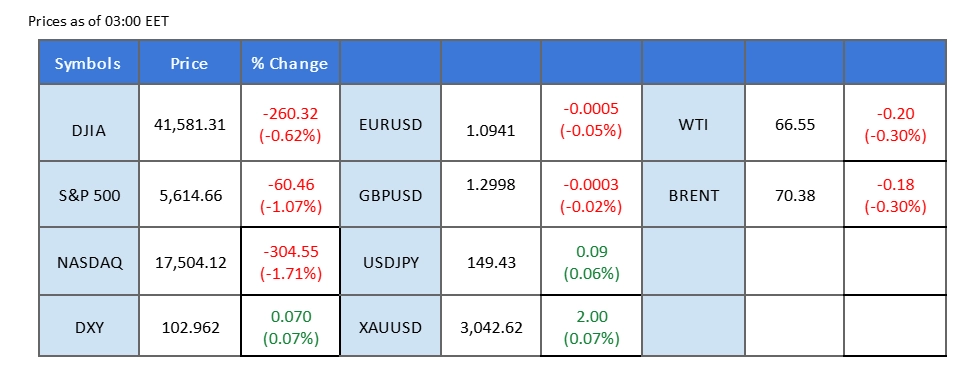

Market Summary

The Federal Reserve’s rate decision was announced yesterday, aligning with market expectations as the central bank opted to keep rates unchanged. However, the real market mover came during Fed Chair Jerome Powell’s press conference following the announcement. Powell highlighted concerns over inflationary pressures stemming from the aggressive trade policies imposed by the Trump administration, which could pose challenges to price stability. Additionally, he acknowledged signs of a slowing U.S. economy and an easing labor market—comments that reinforced a dovish interpretation of his speech.

As a result, Wall Street rallied, with all three major indices closing higher, while U.S. Treasury yields tumbled to fresh lows. The softer yields weighed on the U.S. dollar, keeping the greenback under pressure against its peers. Meanwhile, in the eurozone, the latest CPI reading came in below both the previous figure and market expectations, dealing a blow to the euro.

The Australian dollar also took a sharp hit after a surprisingly weak jobs report, which showed employment falling by 52.8k—significantly worse than market forecasts—sending the currency lower.

In today’s forex market, traders are turning their focus to the Bank of England’s interest rate decision and Governor Andrew Bailey’s remarks, which could shape expectations for the pound’s trajectory.

In the commodities market, gold continued its relentless climb, surging past the $3,050 mark. The precious metal has now gained over 2% this week without any notable pullback, signaling that bullish momentum remains firmly intact.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

Market Overview

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

The US Dollar dipped following the FOMC meeting, as dovish expectations suggested the Fed may continue easing before tightening again. The Federal Reserve kept interest rates unchanged in its target range of 4.25% to 4.5% and reaffirmed its forecast for two rate cuts in 2025, despite persistent tariff-driven inflation concerns. Fed Chair Jerome Powell acknowledged that recession risks have increased but maintained that a severe downturn remains unlikely. The central bank lowered its economic growth forecast, now expecting 1.7% GDP growth in 2025—a 0.4 percentage point downgrade.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 30, suggesting the index might enter oversold territory.

Resistance level: 105.65, 107.60

Support level: 103.30, 101.70

Gold prices surged to record highs as the Fed’s commitment to rate cuts fueled demand for the safe-haven asset, despite the risks of inflation from rising trade tariffs. Recession fears have further driven investors toward gold. Meanwhile, Russia-Ukraine hostilities persist, with talks of a 30-day ceasefire on energy infrastructure attacks yielding no progress. In the Middle East, tensions escalated as Israeli airstrikes killed 400 people on Tuesday, intensifying geopolitical risks and adding further support for gold prices.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 73, suggesting the commodity might enter overbought territory.

Resistance level: 3050.00, 3095.00

Support level: 3005.00, 2950.00

The British pound capitalized on a weaker U.S. dollar in the last session, propelling GBP/USD above its immediate resistance at the 1.3000 mark—a bullish signal for the pair. The greenback remained under pressure following the Federal Reserve’s dovish tone, as policymakers acknowledged signs of a slowing U.S. economy and an easing labour market. Attention now turns to the Bank of England’s interest rate decision, with markets widely expecting the central bank to hold rates steady. While such a move is already priced in, any hawkish signals from BoE policymakers could further support the pound, allowing the pair to extend its gains.

The pair has been trading in a higher-low price pattern and has broken above its psychological resistance level at the 1.3000 mark, suggesting a bullish signal for the pair. The RSI remains hovering above the 50 level, while the MACD shows signs of rebounding from above the zero line, suggesting that the pair remains trading with bullish momentum.

Resistance level: 1.3100, 1.3178

Support level: 1.2880, 1.2788

The EUR/USD pair remained capped below its resistance at the 1.0955 mark as opposing forces kept the pair in consolidation. The U.S. dollar continued to trade on the back foot after the market priced in a dovish narrative from Fed Chair Jerome Powell’s speech, which reinforced expectations of a looser monetary stance. However, the euro struggled to capitalize on the dollar’s weakness after eurozone CPI data came in below expectations, raising concerns that the ECB may adopt a more dovish policy stance.

The pair remained subdued in the last session, which gave a neutral signal. The RSI is gradually sliding while the MACD is flowing flat at near the zero line, suggesting that the bullish momentum is minimal with the pair.

Resistance level: 1.0955, 1.1075

Support level: 1.0806, 1.0672

The Japanese yen remained steady after the Bank of Japan (BOJ) held interest rates unchanged at 0.50%, signaling a wait-and-see approach amid concerns over the potential impact of US tariffs announced by President Donald Trump. The BOJ maintained an optimistic outlook, forecasting a moderate economic recovery driven by domestic factors, which provided support for the yen.

USD/JPY is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 29, suggesting the pair might enter oversold territory.

Resistance level: 148.45, 149.25

Support level: 147.70, 146.75

The US equity market rebounded sharply, led by yield-sensitive indices, with the Nasdaq rising 1.4% following the Fed’s rate decision. Although the Fed keep rates unchanged, its forecast for two rate cuts in 2025 bolstered market sentiment, even as policymakers acknowledged a stubborn inflation trajectory. US Treasury yields declined, further supporting equity markets. In the corporate sector, Tesla (NASDAQ:TSLA) jumped over 4% after securing an initial approval toward launching its robotaxi service in California. Meanwhile, NVIDIA (NASDAQ:NVDA) rose more than 2%, as CEO Jensen Huang downplayed the near-term impact of tariffs.

Nasdaq is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 45, suggesting the index might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 19900.00, 20490.00

Support level: 19160.00, 18405.00

After breaking above its psychological resistance level at the $5.00 mark, copper prices extended gains by another 1% without any notable retracement, reinforcing a strong bullish outlook. The initial catalyst came from the proposed metal tariffs under Trump’s administration, which fueled expectations of supply constraints and higher costs. Further strengthening the rally, the latest Chinese economic data surprised to the upside, improving sentiment around industrial demand. As China remains the world’s largest consumer of Copper, the upbeat data bolstered demand expectations, providing additional support for copper prices to continue their climb.

Copper prices edged higher after breaking above their key resistance level at the 5.00 mark, suggesting a bullish bias for Copper. The RSI edged higher in the overbought zone while the MACD continued to climb, suggesting that the bullish momentum is gaining.

Resistance level: 5.206, 5.400

Support level: 4.943, 4.810

Scambia forex, indici, Metalli e altro ancora a spread bassi e con un'esecuzione fulminea.

Registrati per un Conto Reale PU Prime con la nostra semplice procedura.

Finanzia senza fatica il tuo conto con un'ampia gamma di canali e valute accettate.

Accedi a centinaia di strumenti a condizioni di trading leader del mercato.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!