Scarica l'app

-

- Piattaforme di trading

- App PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Condizioni di Trading

- Tipi di Account

- Spread, Costi e Swap

- Depositi e Prelievi

- Tariffe e spese

- Orari di Trading

Scarica l'app

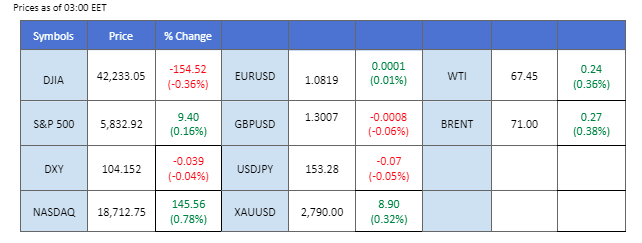

Market Summary

Gold surged to an all-time high in the last trading session, climbing above the $2,780 mark. Multiple bullish factors have fueled this rally, including intensifying geopolitical tensions in the Middle East and Eastern Europe, which have heightened demand for safe-haven assets. Additionally, as markets brace for the U.S. election, investors are showing a strong preference for gold as a hedge against uncertainty.

On Wall Street, Alphabet Inc.’s impressive earnings report lifted the Nasdaq to a recent high, while earnings from Meta Platforms and Microsoft Inc., due today, are expected to introduce volatility in the market.

In the forex market, Australia’s CPI reading came in at 2.8%, meeting market expectations but falling 1% from the previous reading. This decline suggests that inflationary pressures in Australia may be easing, potentially leading the Reserve Bank of Australia to consider more accommodative policy measures, which could weigh on the Australian dollar.

Meanwhile, Bitcoin (BTC) touched its highest level since March, driven by optimistic sentiment in the crypto market ahead of the U.S. presidential election. This momentum potentially propels BTC toward the $80,000 mark in the near term.

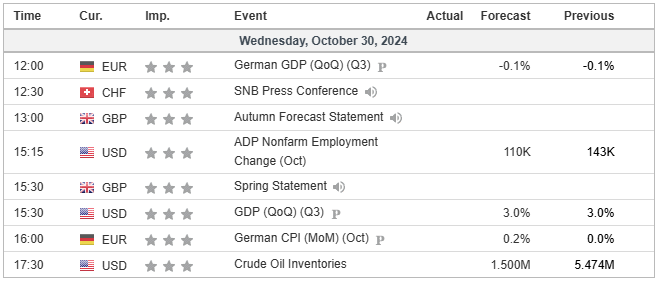

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (7%) VS -25 bps (97%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index retreated slightly following weaker-than-expected JOLTs job openings data, which fell to 7.443 million, missing the expected 7.980 million and marking the lowest level since January 2021. This data points to potential softening in the U.S. labor market, leading investors to adopt a cautious stance as they await additional economic indicators, including the Nonfarm Payrolls, Core PCE Price Index, and GDP releases later this week. With a data-dependent environment unfolding, traders are encouraged to monitor these releases closely for clearer signals on the dollar’s trajectory.

The Dollar Index is trading lower while currently near the support level. MACD has illustrated increasing bearish momentum, while RSI is at 49, suggesting the index might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 104.95, 105.55

Support level: 103.95, 103.20

Gold prices surged to fresh record highs, supported by weaker U.S. economic data and growing uncertainties as the 2024 U.S. Presidential election approaches. Recent polling data shows a close race between Donald Trump and Kamala Harris, though prediction markets indicate a lead for Trump, fueling concerns about the U.S. debt outlook and boosting safe-haven appeal. The downturn in U.S. job openings further weighed on economic sentiment, shifting investors toward gold as a safer asset amidst potential economic instability.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 73, suggesting the commodity might enter overbought territory.

Resistance level: 2775.00, 2795.00

Support level: 2755.00, 2720.00

The GBP/USD pair climbed above the 1.3000 psychological level after being suppressed below it for the past week. This recent breakout was primarily driven by easing dollar strength in the last session, allowing the pair to post a technical rebound. However, traders remain cautious as the U.S. GDP report, set for release today, is expected to play a pivotal role in determining the pair’s near-term direction. A stronger-than-expected GDP reading could renew support for the dollar, potentially testing GBP/USD’s ability to sustain its gains above 1.3000.

GBP/USD recorded a higher-high price pattern, suggesting a potential technical rebound for the pair. The RSI has surged past the 50 level while the MACD is on the brink of crossing above the zero line, suggesting a potential trend reversal for the pair.

Resistance level: 1.3045, 1.3125

Support level: 1.2940, 1.2850

The EUR/USD pair surged past the 1.0800 level from recent lows in anticipation of the eurozone GDP release scheduled for today. Expectations are that the GDP figure will exceed the prior reading, potentially fueling further upward momentum for the pair. However, traders remain vigilant as the U.S. GDP report, due later in the day, could influence the pair’s trajectory. A stronger-than-expected U.S. GDP could renew dollar demand, challenging the euro’s recent gains.

The pair has eased from the bearish trend, and the pair has found support at the near 1.0775 mark. The RSI is hovering close to the 50 level while the MACD is about to cross above from the zero line, suggesting a bullish momentum for the pair.

Resistance level:1.0890, 1.0950

Support level: 1.0735, 1.0675

The AUD/USD pair continues to experience strong bearish momentum, pushing it down to recent lows. Although today’s Australian CPI report exceeded market expectations and initially offered a brief reprieve, the gains were quickly erased. The pair is now testing the critical support level at 0.6544; a break below this threshold could signal further downside. Persistent pressure on the Australian dollar reflects broader market sentiment, as economic challenges continue to weigh heavily despite the positive CPI surprise.

The pair remains trading with strong bearish momentum; a break below its next support level shall be a solid bearish signal for the pair. The RSI is breaking into the oversold zone while the MACD is edging lower, suggesting the bearish momentum is gaining.

Resistance level: 0.6610, 0.6670

Support level: 0.6490, 0.6420

The Nasdaq hit record highs on Tuesday as the technology sector gained momentum in anticipation of key earnings releases from several major players, including Alphabet, Meta Platforms, Microsoft, Apple, and Amazon. With these “Magnificent Seven” firms representing substantial market capitalization, their earnings are set to serve as a benchmark for broader market performance. Investors will closely assess whether these firms have capitalised on their AI investments, a focal point in recent quarters, to maintain their growth trajectory.

Nasdaq is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 63, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 20575.00, 21075.00

Support level: 19705.00, 19120.00

Oil prices closed slightly lower on Tuesday, extending a 6% drop from earlier in the week. Israeli Prime Minister Benjamin Netanyahu is reportedly considering a diplomatic resolution to the ongoing conflict in Lebanon, which has alleviated some supply disruption concerns. Additionally, declining oil demand from China, the world’s largest crude oil importer, remains a drag on global oil consumption and continues to apply downward pressure on prices.

Oil prices are trading lower while currently testing the support level. However, MACD has illustrated increasing bullish momentum, while RSI is at 40, suggesting the commodity might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 68.35, 69.90

Support level: 67.10, 65.55

Scambia forex, indici, Metalli e altro ancora a spread bassi e con un'esecuzione fulminea.

Registrati per un Conto Reale PU Prime con la nostra semplice procedura.

Finanzia senza fatica il tuo conto con un'ampia gamma di canali e valute accettate.

Accedi a centinaia di strumenti a condizioni di trading leader del mercato.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!