Scarica l'app

-

- Piattaforme di trading

- App PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Commerciante web

- PU Sociale

-

- Condizioni di Trading

- Tipi di conto

- Spread, Costi e Swap

- Depositi e Prelievi

- Tariffe e spese

- Orari di Trading

Scarica l'app

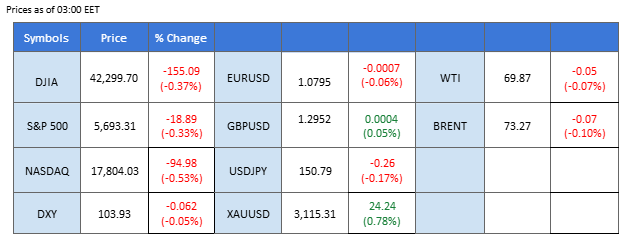

Sintesi del mercato

Gold prices continued their bullish momentum, surging past $3,077.41 without significant retracement, marking a 7% gain in March. The rally underscores strong haven demand as geopolitical and economic uncertainties mount.

The latest escalation in Ukraine, where Russian drone strikes targeted the country’s second and third-largest cities, has heightened risk aversion. Meanwhile, European allies in Paris reaffirmed their stance on maintaining sanctions on Russia, rejecting demands for relief in ceasefire negotiations—further intensifying regional tensions.

Additionally, markets remain cautious ahead of Trump’s tariff policy, set to take effect on April 2, adding to the uncertainty driving investors toward gold.

The U.S. dollar struggled for direction after mixed GDP data, with traders now shifting focus to the upcoming PCE reading, a key inflation gauge that could influence the Fed’s policy stance.

Meanwhile, the Pound Sterling remains one of the strongest G7 currencies, with UK GDP and Retail Sales data scheduled for release today—key drivers that could shape the currency’s near-term trajectory.

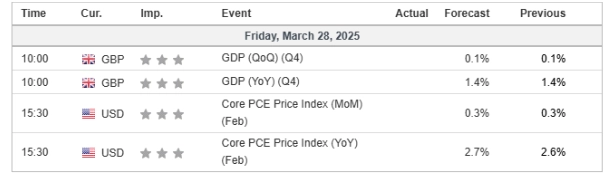

Le attuali scommesse sul rialzo dei tassi 7th May Fed interest rate decision:

Fonte: Strumento Fedwatch del CME

0 bps (86.4%) VS -25 bps (13.6%)

Panoramica del mercato

Calendario economico

(Tempo del sistema MT4)

Fonte: MQL5

Movimenti di mercato

The US Dollar Index dipped, weighed down by escalating trade tensions. Trump’s tariff plans have sparked backlash from Europe, Canada, China, and Mexico, all of which are threatening retaliatory measures. While the dollar typically benefits from risk-off sentiment, concerns over de-dollarization and shifting global trade alliances have limited its upside. Investors are now eyeing the upcoming US Core PCE Price Index report, a key inflation gauge that could determine the greenback’s next move.

The Dollar Index is trading lower following the prior retracement from the resistance level. However, MACD has illustrated increasing bullish momentum, while RSI is at 43, suggesting the index might experience technical correction since the RSI rebounded from oversold territory.

Resistance level: 104.55, 105.90

Support level: 103.25, 101.85

Gold prices soared to an all-time high as investors fled to safe-haven assets following Trump’s surprise 25% tariff on auto imports. The move has stoked fears of trade disruptions, with economists warning of potential slowdowns in Japan, Europe, and South Korea. Additionally, uncertainty ahead of Trump’s April 2 tariff announcement, which could target 15 major US trading partners, has further fueled demand for gold.

Gold prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 74, suggesting the commodity might experience technical correction since the RSI entered overbought territory.

Resistance level: 3090.00, 3115.00

Support level: 3055.00, 3030.00

The British Pound remains one of the strongest currencies among its G7 peers, with the GBP/USD pair finding support at 1.2785 after a technical retracement. The pair rebounded as the U.S. dollar struggled for momentum following mixed economic data in the previous session. Market attention is now on two key economic releases that could drive price action: the UK GDP data and the U.S. PCE inflation reading. Should the pair break above the previous high at 1.2960, it would signal further bullish momentum.

GBP/USD has formed a double-bottom price action and performed a technical rebound, suggesting a bullish bias for the pair. The RSI hovering between the 50 level while the MACD is set to break above from the zero line suggests that the bearish momentum is easing.

Resistance level: 1.3000, 1.3100

Support level: 1.2875,1.2785

EUR/USD snapped its six-day losing streak and posted a gain in the last session, as the U.S. dollar lost momentum following the release of mixed U.S. GDP data. Despite the rebound, the pair remains below its immediate resistance at 1.0806, indicating that a clear trend reversal has yet to materialize. Market participants are now turning their attention to the upcoming U.S. PCE inflation reading, a key indicator for the Federal Reserve’s monetary policy outlook. A stronger-than-expected PCE print could reignite dollar strength and pressure the euro lower.

The pair performed a minor technical rebound in the last session but remains trading within its downtrend trajectory, suggesting a bearish bias. The RSI remains below the 50 level, while the MACD flows flat below the zero line, suggesting that the pair remains trading with bearish momentum.

Livello di resistenza: 1,0956, 1,1075

Livello di supporto: 1,0672, 1,0527

The GBP/JPY pair surged to a new high for 2025 before encountering a technical retracement during the Asian session on Friday. The Japanese yen found some temporary relief following the release of Tokyo’s CPI data, which came in higher than market expectations. However, the broader trend for the yen remains weak, as persistent downside pressure continues to weigh on the currency. Despite the brief pause, the pair remains in a bullish trajectory, with the stronger pound maintaining dominance.

The GBP/JPY pair remains within its uptrend channel and breaks a new high, suggesting a bullish bias. The RSI remains close to the overbought zone, while the MACD shows signs of a rebound, suggesting that the pair remains trading with bullish momentum.

Resistance level: 198.78, 201.35

Support level: 192.15, 189.20

Wall Street extended its losing streak, with investor confidence eroding under the weight of mounting trade war risks. Fears of weaker corporate earnings and slowing economic growth have rattled markets, keeping risk appetite in check. Until there’s clarity on tariff policies, equities may remain under pressure.

Nasdaq is trading lower while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 45, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 19925.00, 20445.00

Support level: 19160.00, 18405.00

Crude oil prices remain range-bound, caught between trade war risks and tightening supply conditions. Fears of slower global growth due to Trump’s tariffs have raised concerns over weakening oil demand. However, a larger-than-expected drop in US crude inventories and potential new sanctions on Venezuelan oil are providing some support. Traders are bracing for Trump’s April 2 tariff update, which could further impact the global demand outlook.

Oil prices are trading flat while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 57, suggesting the commodity might experience technical correction since the RSI retreated into midline.

Resistance level: 70.00, 71.20

Support level: 69.30, 68.50

Scambia forex, indici, metalli e altro ancora a spread bassi e con un'esecuzione fulminea.

Registrati per un Conto Reale PU Prime con la nostra semplice procedura.

Finanzia senza fatica il tuo conto con un'ampia gamma di canali e valute accettate.

Accedi a centinaia di strumenti a condizioni di trading leader del mercato.

Il Sito è destinato a persone residenti in giurisdizioni in cui l'accesso al Sito è consentito dalla legge.

Si prega di notare che PU Prime e le sue entità affiliate non hanno sede né operano nella giurisdizione del vostro paese.

Facendo clic sul pulsante "Riconosci", l'utente conferma di essere entrato in questo sito web esclusivamente su sua iniziativa e non come risultato di una specifica attività di marketing. Desiderate ottenere informazioni da questo sito web che sono fornite su sollecitazione inversa in conformità con le leggi della vostra giurisdizione.

Grazie per il vostro riconoscimento!

Tenete presente che il sito web è destinato a persone che risiedono in giurisdizioni in cui l'accesso al sito web è consentito dalla legge.

Tieni presente che PU Prime e le sue entità affiliate non sono stabilite né operano nella tua giurisdizione di origine.

Facendo clic sul pulsante "Accetta", si conferma che si sta accedendo a questo sito web per iniziativa propria e non come risultato di alcuno sforzo di marketing specifico. Desideri ottenere informazioni da questo sito web che ti vengono fornite tramite una richiesta inversa in conformità con le leggi della tua giurisdizione di origine.

Grazie per il vostro riconoscimento!