Scarica l'app

-

- Piattaforme di trading

- App PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Commerciante web

- PU Sociale

-

- Condizioni di Trading

- Tipi di conto

- Spread, Costi e Swap

- Depositi e Prelievi

- Tariffe e spese

- Orari di Trading

Scarica l'app

Sintesi del mercato

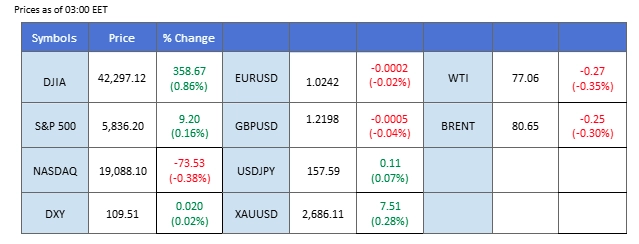

As President-elect Donald Trump’s inauguration approaches, the market is keenly monitoring developments tied to his proposed policies, leading to notable market reactions. The U.S. dollar underwent a technical correction yesterday, driven by sentiment that the robust U.S. economy does not necessitate Trump’s aggressive protectionist measures. This perceived policy moderation allowed Wall Street to post gains, while the dollar experienced a sell-off, albeit remaining at elevated levels. Wall Street, however, has yet to decisively break out of its broader bearish trend.

Despite the dollar’s dip, safe-haven gold failed to capitalize, remaining below the critical $2,700 mark. The metal’s momentum was dampened by promising news from Doha, where negotiators from Gaza and Israel are reportedly finalizing a ceasefire agreement. Conversely, oil prices maintained their strength, supported by better-than-expected Chinese trade data and the impact of U.S. sanctions on Russian crude, which continue to bolster market optimism.

In the cryptocurrency market, Bitcoin dipped below the $90,000 mark for the first time in nearly two months, underscoring persistent bearish sentiment. However, with President Trump set to take the oath of office in a week, many crypto enthusiasts are anticipating a resurgence of the “Trump-trade” rally, which could potentially revive Bitcoin and other cryptocurrencies in the near term.

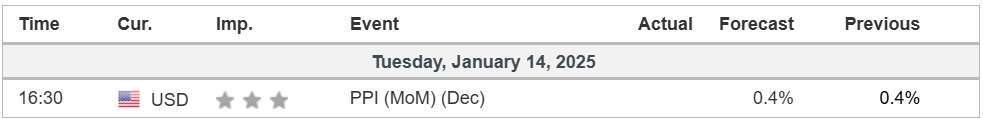

Le attuali scommesse sul rialzo dei tassi 29 gennaio Decisione sui tassi di interesse della Fed:

Fonte: Strumento Fedwatch del CME

0 bps (97,9%) VS -25 bps (2,1%)

(Tempo del sistema MT4)

Fonte: MQL5

Movimenti di mercato

DOLLARO_INDICE, H4

The Dollar Index extended its rally, driving major currencies to multi-year lows as markets absorbed last week’s strong U.S. jobs report. The robust labor data has solidified expectations for a prolonged high-rate environment, with analysts revising forecasts to anticipate only two rate cuts this year, down from the previously projected three. Investors now await Wednesday’s U.S. inflation report, expected to provide pivotal clues about the Federal Reserve’s policy direction and its approach to inflationary pressures.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 72, suggesting the index might enter overbought territory.

Resistance level: 111.00, 114.65

Support level: 107.35, 104.20

Gold prices recovered sharply after briefly dipping, bouncing off the critical 2665.00 support level—a signal of strong buying interest. Inflation risks stemming from Trump-era policies and ongoing geopolitical trade tensions are expected to underpin further gains in gold. With U.S. economic data in focus, market participants should closely monitor upcoming reports for insights into the precious metal’s trajectory, particularly as inflationary expectations evolve.

I prezzi dell'oro sono in rialzo dopo il precedente rimbalzo dal livello di supporto. Il MACD ha mostrato una diminuzione del momentum ribassista, mentre l'RSI è a 52, suggerendo che la commodity potrebbe estendere i suoi guadagni dal momento che l'RSI rimane al di sopra della linea mediana.

Livello di resistenza: 2690.00, 2720.00

Support level: 2665.00, 2635.00

The GBP/USD pair has rebounded from its recent low and successfully broken above its downtrend resistance level, signaling a potential trend reversal. With the Pound Sterling lacking a strong catalyst, the pair’s movement remains largely influenced by the U.S. dollar’s performance. In yesterday’s session, a softer dollar provided an opportunity for the pair to stage a technical rebound. However, without a clear catalyst for sustained bullish momentum, the pair’s future direction will likely hinge on broader dollar dynamics and upcoming macroeconomic developments.

The pair has performed a technical rebound while the bearish momentum has eased, suggesting a trend reversal. The RSI remains at the lower levels, while the MACD has a golden cross at the bottom, suggesting that the bearish momentum is easing.

Livello di resistenza: 1,2310, 1,2410

Livello di supporto: 1,2140, 1,2060

The EUR/USD pair experienced a minor technical rebound but formed a doji candlestick at the peak, indicating a potential exhaustion of the rebound. This movement was supported by a temporary softening of the U.S. dollar during the previous session as market sentiment shifted cautiously ahead of President-elect Donald Trump’s inauguration. Despite this brief pullback in dollar strength, the underlying bullish momentum for the dollar remains intact, which could continue to exert downward pressure on the EUR/USD pair in the near term. The pair’s trajectory will likely hinge on developments surrounding U.S. policy expectations and broader market sentiment.

Despite a technical rebound, the pair remains trading in a bearish trajectory. The RSI has surged above the oversold zone, while the MACD is about to cross at the bottom, suggesting that the bearish momentum is easing.

Resistance level: 1.0330, 1.0458

Support level: 1.0112, 1.0001

The GBP/JPY pair, after experiencing a sharp 4% decline over the past week, managed a technical rebound in the last session but faced rejection at the fair-value gap, reinforcing its bearish trajectory. The pair’s inability to sustain gains highlights persistent selling pressure. On the fundamental side, Japan’s improved Trade Balance data compared to previous readings has lent strength to the Japanese Yen. This bolstered Yen performance is likely to continue weighing on the pair, especially as the broader market sentiment remains cautious. As such, GBP/JPY may struggle to break out of its bearish trend in the near term.

The GBP/JPY pair is trading within its bearish trajectory despite a technical rebound. The RSI rebounded slightly while the MACD was about to cross at the bottom, suggesting that the bearish momentum was easing.

Resistance level: 194.05, 196.00

Support level: 189.95, 187.80

U.S. stocks advanced on Monday, with energy shares leading gains thanks to a modest recovery in oil prices, while the technology sector underperformed. Investors are gearing up for the fourth-quarter earnings season, with major banks like JPMorgan Chase, Goldman Sachs, and Bank of America set to release their results this week.

Dow Jones is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 42, suggesting the index might extend its gains since the RSI rebounded from oversold territory.

Livello di resistenza: 42900.00, 43920.00

Livello di supporto: 41875.00, 40610.00

Oil prices jumped 2% to reach a four-month high, driven by speculation that expanded U.S. sanctions on Russian oil could disrupt global supply chains. Buyers in India and China may need to turn to alternative suppliers, exacerbating supply challenges. Goldman Sachs reported that vessels affected by the sanctions transported approximately 1.7 million barrels per day (bpd) in 2024, accounting for 25% of Russia’s oil exports.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is t 74, suggesting the commodity might enter overbought territory.

Livello di resistenza: 78,75, 83,75

Livello di supporto: 72,95, 66,85

Scambia forex, indici, metalli e altro ancora a spread bassi e con un'esecuzione fulminea.

Registrati per un Conto Reale PU Prime con la nostra semplice procedura.

Finanzia senza fatica il tuo conto con un'ampia gamma di canali e valute accettate.

Accedi a centinaia di strumenti a condizioni di trading leader del mercato.

Il Sito è destinato a persone residenti in giurisdizioni in cui l'accesso al Sito è consentito dalla legge.

Si prega di notare che PU Prime e le sue entità affiliate non hanno sede né operano nella giurisdizione del vostro paese.

Facendo clic sul pulsante "Riconosci", l'utente conferma di essere entrato in questo sito web esclusivamente su sua iniziativa e non come risultato di una specifica attività di marketing. Desiderate ottenere informazioni da questo sito web che sono fornite su sollecitazione inversa in conformità con le leggi della vostra giurisdizione.

Grazie per il vostro riconoscimento!

Tenete presente che il sito web è destinato a persone che risiedono in giurisdizioni in cui l'accesso al sito web è consentito dalla legge.

Tieni presente che PU Prime e le sue entità affiliate non sono stabilite né operano nella tua giurisdizione di origine.

Facendo clic sul pulsante "Accetta", si conferma che si sta accedendo a questo sito web per iniziativa propria e non come risultato di alcuno sforzo di marketing specifico. Desideri ottenere informazioni da questo sito web che ti vengono fornite tramite una richiesta inversa in conformità con le leggi della tua giurisdizione di origine.

Grazie per il vostro riconoscimento!