Scarica l'app

-

- Piattaforme di trading

- App PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Commerciante web

- PU Sociale

-

- Condizioni di Trading

- Tipi di conto

- Spread, Costi e Swap

- Depositi e Prelievi

- Tariffe e spese

- Orari di Trading

Scarica l'app

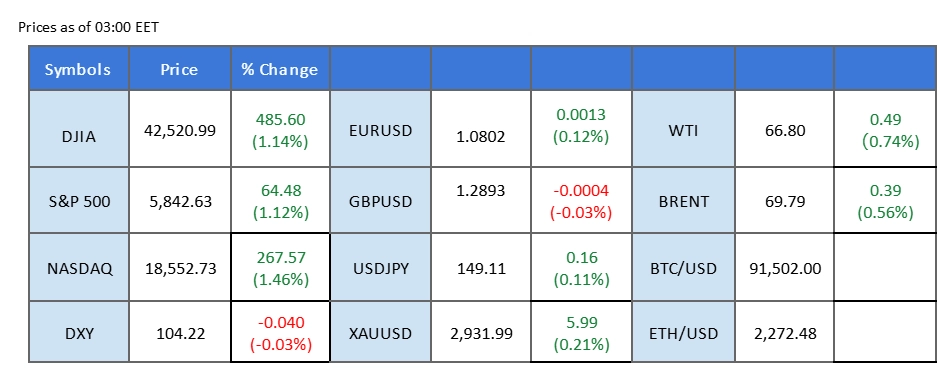

Sintesi del mercato

Wall Street snapped its week-long losing streak, staging a technical rebound in the last session, with the Dow Jones reclaiming the 43,000 mark. The recovery came after former U.S. President Donald Trump announced a delay in auto tariffs on Canada, though reciprocal tariffs are still set to take effect on April 2. The Canadian dollar found relief from yet another policy reversal by the Trump administration, with the USD/CAD pair posting its second consecutive daily decline as the greenback softened.

In the European market, the euro surged to its highest level since last November, with EUR/USD rallying sharply. The main catalyst behind the euro’s strength was a selloff in German Bunds, as markets reacted to expectations that the newly elected German Chancellor will push through a major government spending package focused on infrastructure and defense. The resulting spike in Bund yields fueled expectations of higher interest rates, driving the euro higher.

Gold prices held firmly above the $2,900 mark as uncertainty in the broader financial markets persisted. Should the U.S. dollar continue to weaken, gold could extend its gains in the near term. Meanwhile, oil prices remained subdued, with WTI trading below the $70 level, as Trump’s aggressive trade policies cast a shadow over global demand expectations.

In the crypto space, volatility remained elevated as macroeconomic factors continued to shape risk sentiment. However, the delay in auto tariffs on Canada helped to stabilize market sentiment, lifting Bitcoin (BTC) above the $90,000 mark in the last session.

Le attuali scommesse sul rialzo dei tassi 19 marzo Decisione sui tassi di interesse della Fed:

Fonte: Strumento Fedwatch del CME

0 bps (95%) VS -25 bps (5%)

Panoramica del mercato

Calendario economico

(Tempo del sistema MT4)

Fonte: MQL5

Movimenti di mercato

Despite a series of stronger-than-expected U.S. economic reports, the U.S. dollar continued to weaken as market participants expressed doubts about the sustainability of U.S. economic growth. Many global economies are adopting aggressive stimulus plans to accelerate recovery, raising concerns that U.S. tariff policies may not provide similar short-term benefits. Additionally, the potential for retaliatory trade measures and ongoing discussions around de-dollarization further dampened sentiment toward the greenback.

Il Dollar Index è in ribasso e sta testando il livello di supporto. Tuttavia, il MACD ha mostrato una diminuzione del momentum ribassista, mentre l'RSI è a 30, suggerendo che l'indice potrebbe entrare in territorio di ipervenduto.

Resistance level: 106.40, 107.60

Support level: 105.45, 104.45

Gold prices have surged past the $2,920 resistance level, signaling a strong bullish breakout. The precious metal remains in high demand as market uncertainty intensifies following the Trump administration’s aggressive trade policies against key U.S. trading partners. Adding to the risk-off sentiment, geopolitical tensions in Europe continue to weigh on investor confidence. Germany is set to pass a significant defense spending bill, reflecting growing concerns over the prolonged Ukraine-Russia conflict. With safe-haven demand on the rise, gold prices are likely to remain well-supported in the near term.

Gold prices have broken above the price consolidation range, suggesting a bullish signal for the pair. The RSI remains elevated, while the MACD has broken above the zero line, suggesting that gold remains trading with bullish momentum.

Resistance level: 2955.00, 3000.00

Support level: 2900.00, 2875.00

USD/CAD,H4

The Canadian economy received a boost after President Trump announced a one-month delay in auto tariffs on Canada, providing a temporary reprieve for the country’s auto sector. The extension eased trade concerns, fueling a rebound in the Canadian dollar. Meanwhile, the U.S. dollar remained lacklustre, contributing to further downside pressure on USD/CAD. The pair has dropped more than 1% from its peak on Monday, as investors recalibrate expectations amid shifting trade policies and broader market uncertainty.

USD/CAD is trailing lower and has reached a new low this week, suggesting a bearish bias for the pair. The RSI continues to slide while the MACD is poised to break below the zero line, suggesting that bearish momentum is forming.

Resistance level: 1.4355, 1.4460

Livello di supporto: 1,4265, 1,4155

The USD/JPY pair is hovering near its recent low, with the 149.0 level serving as a key short-term support. A break below this threshold could signal further downside for the pair. The sharp rise in Japan’s 10-year bond yield—surging above 1.5% for the first time since 2009—reflects growing market expectations that the Bank of Japan (BoJ) will raise interest rates this month. The prospect of tighter monetary policy has fueled demand for the yen, adding to the downward pressure on USD/JPY.

The pair remain trading in a lower-low price pattern, suggesting a bearish bias for the pair. The RSI has been flowing at below the 50 level while the MACD is flirting with the zero line, suggesting that the pair remain trading with bearish momentum,

Livello di resistenza: 149,50, 151,30

Livello di supporto: 147.00, 143.80

The euro strengthened, driven by expectations of large-scale fiscal stimulus in the region. European markets reacted positively to the U.S. decision to pause military aid to Ukraine, a move that eased some geopolitical uncertainties. The European Commission’s decision to trigger national escape clauses from the Stability and Growth Pact could unlock €650 billion in national spending, alongside additional measures totaling €800 billion. Furthermore, Germany’s agreement to suspend its debt brake and introduce a €500 billion infrastructure fund further bolstered investor confidence in the eurozone’s economic outlook.

EUR/USD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 72, suggesting the pair might enter overbought territory.

Resistance level:1.0805, 1.0955

Support level: 1.0670, 1.0525

HK50 soared as Chinese authorities committed to robust stimulus measures aimed at strengthening economic growth. During the National People’s Congress (NPC), China reaffirmed its 5% GDP growth target for 2025 and introduced initiatives to stimulate domestic consumption, including subsidies, pension increases, and financial aid for households. These measures are designed to counter deflationary pressures, a sluggish property sector, and recent U.S. tariff hikes.

HK50 is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 72, suggesting the HK50 might enter overbought territory.

Resistance level: 24915.00, 27770.00

Support level: 22535.00, 19600.00

Crude oil prices retreated amid progress in U.S.-Iran nuclear negotiations and renewed Russia-Ukraine ceasefire discussions. Hopes for a diplomatic breakthrough raised the possibility of sanction relief for Iran, potentially increasing global oil supply and putting downward pressure on prices. However, failure in talks could lead to tighter restrictions on Iranian exports, offering a counterbalance to supply concerns.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 46, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 68.30, 69.30

Support level: 66.75, 65.50

Scambia forex, indici, metalli e altro ancora a spread bassi e con un'esecuzione fulminea.

Registrati per un Conto Reale PU Prime con la nostra semplice procedura.

Finanzia senza fatica il tuo conto con un'ampia gamma di canali e valute accettate.

Accedi a centinaia di strumenti a condizioni di trading leader del mercato.

Il Sito è destinato a persone residenti in giurisdizioni in cui l'accesso al Sito è consentito dalla legge.

Si prega di notare che PU Prime e le sue entità affiliate non hanno sede né operano nella giurisdizione del vostro paese.

Facendo clic sul pulsante "Riconosci", l'utente conferma di essere entrato in questo sito web esclusivamente su sua iniziativa e non come risultato di una specifica attività di marketing. Desiderate ottenere informazioni da questo sito web che sono fornite su sollecitazione inversa in conformità con le leggi della vostra giurisdizione.

Grazie per il vostro riconoscimento!

Tenete presente che il sito web è destinato a persone che risiedono in giurisdizioni in cui l'accesso al sito web è consentito dalla legge.

Tieni presente che PU Prime e le sue entità affiliate non sono stabilite né operano nella tua giurisdizione di origine.

Facendo clic sul pulsante "Accetta", si conferma che si sta accedendo a questo sito web per iniziativa propria e non come risultato di alcuno sforzo di marketing specifico. Desideri ottenere informazioni da questo sito web che ti vengono fornite tramite una richiesta inversa in conformità con le leggi della tua giurisdizione di origine.

Grazie per il vostro riconoscimento!