Scarica l'app

-

- Piattaforme di trading

- App PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Commerciante web

- PU Sociale

-

- Condizioni di Trading

- Tipi di conto

- Spread, Costi e Swap

- Depositi e Prelievi

- Tariffe e spese

- Orari di Trading

Scarica l'app

Sintesi del mercato

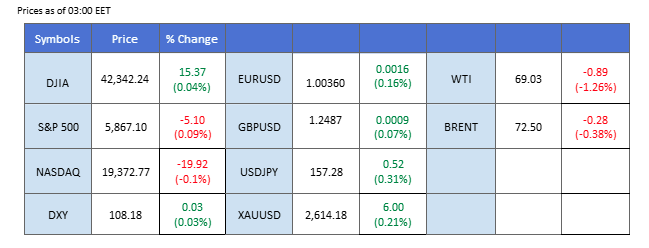

Following the hawkish remarks from the Fed on Wednesday after the interest rate decision, the upbeat U.S. economic indicators released yesterday have further boosted the U.S. dollar, driving it to a two-year high and suggesting a bullish outlook for the greenback. Additionally, the U.S. long-term treasury yield is nearing the 4.6% level, which could also support the dollar.

In contrast, Wall Street remains under pressure as the market digests the Fed’s upcoming monetary policy, with all three major indices staying near their recent lows, indicating strong downside pressure. Similarly, gold has faced pressure from the strengthening dollar and the hawkish Fed stance, trading firmly below the $2,600 level, signaling a bearish bias for the precious metal.

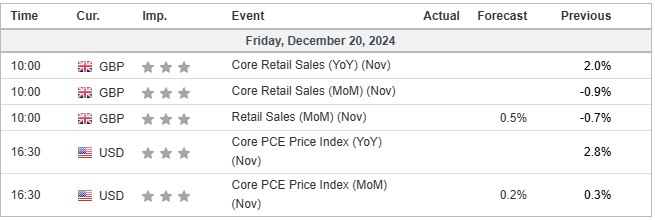

In the forex market, attention is on the UK’s retail sales data, with expectations for a soft reading that could weigh on the Pound Sterling, potentially driving it lower against its peers. Meanwhile, the Japanese Yen has found some support after the Bank of Japan’s hawkish remarks following its interest rate decision.

Le attuali scommesse sul rialzo dei tassi 29 gennaio Decisione sui tassi di interesse della Fed:

Fonte: Strumento Fedwatch del CME

0 bps (93,6%) VS -25 bps (6,4%)

(Tempo del sistema MT4)

Fonte: MQL5

Movimenti di mercato

DOLLARO_INDICE, H4

The U.S. Dollar extended its rally, approaching the next resistance level at 108.60, marking a two-year high. Supporting this strength, U.S. long-term Treasury yields climbed further, reaching 4.6%. Additionally, robust U.S. GDP growth and strong job data released yesterday amplified the bullish momentum for the greenback.

The Dollar Index remains bullish and has gained over 1.3% in 2 sessions. The RSI remain in the overbought zone while the MACD continues to surge, suggesting that the bullish momentum remains strong.

Livello di resistenza: 108,60, 109,50

Livello di supporto: 107,60, 106,75

Gold remains under pressure from the strengthening U.S. Dollar, especially following yesterday’s robust U.S. economic indicators, which highlighted the resilience of the U.S. economy. This has dampened demand for the safe-haven asset.

Gold, despite a technical rebound in the last session, remains trading in a downtrend trajectory and is hovering at its recent low levels. The RSI remains close to the oversold zone while the MACD is edging lower, suggesting that the bearish momentum remains strong.

Resistance level: 2612.50, 2656.00

Support level: 2556.00, 2485.65

The GBP/USD pair, after a technical rebound that filled the Fair Value Gap (FVG) from the previous session, continues to trade within its bearish trend, indicating a negative outlook for the pair. The Bank of England’s dovish stance following the interest rate decision announced yesterday has further exerted downside pressure on the Pound Sterling, contributing to the pair’s decline.

GBP/USD has traded to its 3-week low and has broken from its critical support level at the 1.2505 mark, suggesting a bearish bias for the pair. The RSI is breaking into the overbought zone while the MACD is diverging, suggesting that the bearish momentum is gaining.

Livello di resistenza: 1,2620, 1,2700

Support level:1.2410, 1.2310

The EUR/USD pair, despite a brief rebound, quickly saw its gains erased and is now trading at recent low levels, indicating a bearish outlook for the pair. The European Central Bank remains relatively dovish, expressing concerns about the region’s economic growth. Meanwhile, the U.S. dollar continues to strengthen, supported by strong economic indicators and a hawkish stance from the Federal Reserve, further weighing on the pair.

The EUR/USD heading lower after a technical rebound, a break below from its recent low at 1.0345 mark shall be a bearish signal for the pair. The RSI remains near to the oversold zone while the MACD continues to edge lower, suggesting that the bearish momentum is gaining.

Resistance level: 1.0444, 1.0608

Support level: 1.0324, 1.0238

The USD/JPY pair has surged to new highs and is approaching the 158.00 mark, with a break above this level signaling a potential bullish trend for the pair. However, the Japanese Yen took a brief respite from its bearish trend yesterday, following hints from the Bank of Japan about a potential rate hike early next year. Additionally, the upbeat Japanese CPI reading provided support for the Yen, offering some buoyancy amid the strength of the U.S. dollar.

The pair has surged to a new high, but the bullish momentum has eased slightly; a break below the FVG shall be seen as a trend-reversal signal for the pair. The RSI remains in the overbought zone while the MACD continues to climb, suggesting that the bullish momentum remains strong.

Resistance level:160.00, 163.80

Support level: 153.75, 151.55

The strong U.S. dollar has weighed heavily on oil prices, which dropped to their recent low in the last session, indicating a bearish bias for the commodity. The expensive dollar and the hawkish stance from the Fed are dampening the demand outlook for oil, further pressuring its prices.

Oil prices have traded to a new recent low, suggesting a bearish bias for the oil. The RSI is edging lower while the MACD is poised to break below the zero line, suggesting that the bearish is forming.

Resistance level: 69.90, 72.30

Livello di supporto: 68.25, 67.00

Scambia forex, indici, metalli e altro ancora a spread bassi e con un'esecuzione fulminea.

Registrati per un Conto Reale PU Prime con la nostra semplice procedura.

Finanzia senza fatica il tuo conto con un'ampia gamma di canali e valute accettate.

Accedi a centinaia di strumenti a condizioni di trading leader del mercato.

Il Sito è destinato a persone residenti in giurisdizioni in cui l'accesso al Sito è consentito dalla legge.

Si prega di notare che PU Prime e le sue entità affiliate non hanno sede né operano nella giurisdizione del vostro paese.

Facendo clic sul pulsante "Riconosci", l'utente conferma di essere entrato in questo sito web esclusivamente su sua iniziativa e non come risultato di una specifica attività di marketing. Desiderate ottenere informazioni da questo sito web che sono fornite su sollecitazione inversa in conformità con le leggi della vostra giurisdizione.

Grazie per il vostro riconoscimento!

Tenete presente che il sito web è destinato a persone che risiedono in giurisdizioni in cui l'accesso al sito web è consentito dalla legge.

Tieni presente che PU Prime e le sue entità affiliate non sono stabilite né operano nella tua giurisdizione di origine.

Facendo clic sul pulsante "Accetta", si conferma che si sta accedendo a questo sito web per iniziativa propria e non come risultato di alcuno sforzo di marketing specifico. Desideri ottenere informazioni da questo sito web che ti vengono fornite tramite una richiesta inversa in conformità con le leggi della tua giurisdizione di origine.

Grazie per il vostro riconoscimento!