Scarica l'app

-

- Piattaforme di trading

- App PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Commerciante web

- PU Sociale

-

- Condizioni di Trading

- Tipi di conto

- Spread, Costi e Swap

- Depositi e Prelievi

- Tariffe e spese

- Orari di Trading

Scarica l'app

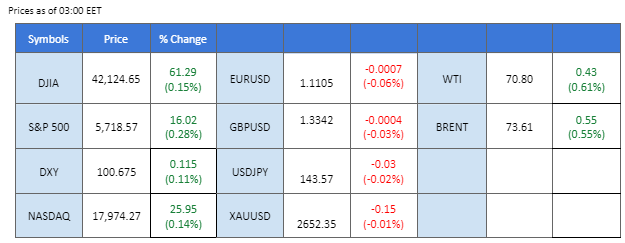

Sintesi del mercato

The U.S. dollar continues to trade at its lowest levels, but the Dollar Index (DXY) has found support above 100.60, with bearish momentum easing. Market sentiment is largely driven by anticipation of another 50 bps rate cut by the Fed before year-end. This week’s GDP and PCE readings will be key in shaping those expectations.

Wall Street remains at all-time highs, with major indexes standing pat, awaiting a catalyst to push them further. In the commodity market, gold is benefiting from a soft dollar and the prospect of continued Fed rate cuts, trading bullishly. Oil prices have also risen to their highest levels this month, aided by improved demand outlook following the Chinese central bank’s surprise rate cut of 10 bps on short-term repo rates.

In the crypto market, Bitcoin (BTC) has surged to its highest level since August, buoyed by improved risk-on sentiment following the Fed’s rate cut. The ongoing accumulation of BTC by MicroStrategy and strong inflows into BTC ETFs are further bolstering confidence in the market.

Lastly, the Reserve Bank of Australia (RBA) is set to announce its interest rate decision tomorrow, with a hawkish stance expected, which has been supporting the strength of the Aussie dollar.

Le attuali scommesse sul rialzo dei tassi 7 novembre Decisione sui tassi di interesse della Fed:

Fonte: Strumento Fedwatch del CME

-50 bps (32%) VS -25 bps (68%)

(Tempo del sistema MT4)

Fonte: MQL5

Movimenti di mercato

DOLLARO_INDICE, H4

Expectations of a 50-basis point rate cut by the Federal Reserve in November have kept the US Dollar flat. Key upcoming data, including the Core PCE inflation report and employment components of the PMI, will shape future monetary decisions. Investors remain in a wait-and-see mode for additional trading trends.

The Dollar Index is trading flat while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 52, suggesting the index might extend its losses after breakout since the RSI retreated from overbought territory.

Resistance level: 101.80, 102.35

Livello di supporto: 100.55, 99.70

The escalation of Israeli airstrikes in Lebanon, resulting in over 492 deaths, triggered risk-off sentiment, prompting a sharp rebound in gold prices. The military conflict between Israel and Hezbollah continues, with thousands of families displaced and Hezbollah launching over 200 rockets into northern Israel.

Gold prices are trading flat while currently testing the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 58, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 2635.00, 2660.00

Support level: 2615.00, 2600.00

The Pound Sterling continues to show resilience as one of the strongest currencies in the market, despite weaker-than-expected UK PMI readings. The disappointing data suggested a potential slowdown in the U.K.’s economic growth, which initially caused a slight dip in the GBP/USD pair. However, this decline was short-lived, as the U.S. dollar eased in strength later in the session. This recovery in the Pound’s strength allowed the pair to spike back to recent high levels, reinforcing the bullish sentiment around the currency.

The GBP/USD pair remains trading with extremely strong bullish momentum and is awaiting a further catalyst to break above its next resistance level at 1.3360. The RSI is hovering close to the overbought zone, while the MACD continues to edge higher, suggesting the pair remains trading with strong bullish momentum.

Resistance level: 1.3360, 1.3440

Support level:1.3280, 1.3140

The EUR/USD pair has eased from its recent bullish run and is now forming a head-and-shoulders price pattern, indicating a potential trend reversal. The euro has been weighed down by poor PMI readings, which came in below the 50 mark, suggesting that the eurozone economy is in contraction. This weakening economic outlook is negatively impacting the euro’s strength. Additionally, the continuous release of weak economic indicators from the eurozone, coupled with the dovish stance from the ECB, is likely to further pressure the pair, potentially driving it lower in the near term.

EUR/USD is forming a head-and-shoulders price pattern, and a lower-high price pattern suggests a trend reversal signal for the pair. The RSI is declining toward the oversold zone, while the MACD is edging lower, suggesting the bullish momentum is vanishing.

Resistance level: 1.1130, 1.1223

Livello di supporto: 1,1020, 1,0920

Despite Fed rate cuts, the US equity market remains resilient, with the S&P 500 hitting record highs. However, risks linger ahead of crucial economic reports and further Fed statements. The Fed’s 50 basis point cut last week could mark the start of an easing cycle that may lower rates by up to 125 bps by year-end, though the overall gains in equity markets have been tempered by the Fed’s cautious medium- to long-term outlook.

S&P 500 is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 68, suggesting the index might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 5790.00, 5900.00

Support level: 5650.00, 5505.00

The AUD/USD pair is holding firm above the previous fair-value gap and is attempting to break above its highest level in 2024, which was recorded in January, signalling a bullish outlook for the pair. Traders are closely monitoring the upcoming RBA interest rate decision, with expectations that the Reserve Bank of Australia will keep rates unchanged, a move that could further bolster the Aussie dollar. Meanwhile, the dovish tone from Fed members continues to weigh on the U.S. dollar, providing additional upward momentum for the pair as it trades near its yearly highs.

The pair is attempting to break above its next resistance level, suggesting a bullish bias. The RSI has been hovering at the above 50 level for weeks, and the MACD continues to edge higher, suggesting the pair remains trading with bullish momentum.

Resistance level: 0.6920, 0.6990

Support level: 0.6780, 0.6730

The EUR/JPY pair declined by over 1% in the last session, driven by weak eurozone economic data that weighed on the euro’s strength. Additionally, the Japanese yen gained momentum, adding further downward pressure on the pair. If the pair fails to hold support at the 159.45 level, it could signal a potential bearish outlook for the pair, with further downside expected if market sentiment continues to favour the yen over the euro.

The pair has dropped drastically by more than 1% in the last session. However, the pair is yet to form a lower-low, suggesting the pair remain trading within its uptrend trajectory. The RSI has dropped out from the overbought zone while the MACD has a deadly cross on the above, suggesting the bullish momentum has eased.

Resistance level: 161.00, 162.95

Support level: 157.60, 155.00

Rising tensions in the Middle East contributed to higher oil prices. In the US, oil producers evacuated staff from Gulf of Mexico platforms as a second major hurricane approached. However, gains were limited by a weak economic outlook, including poor eurozone business activity and concerns over Chinese fuel demand.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 50, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 71.95, 74.15

Support level: 70.40, 68.60

Scambia forex, indici, metalli e altro ancora a spread bassi e con un'esecuzione fulminea.

Registrati per un Conto Reale PU Prime con la nostra semplice procedura.

Finanzia senza fatica il tuo conto con un'ampia gamma di canali e valute accettate.

Accedi a centinaia di strumenti a condizioni di trading leader del mercato.

Il Sito è destinato a persone residenti in giurisdizioni in cui l'accesso al Sito è consentito dalla legge.

Si prega di notare che PU Prime e le sue entità affiliate non hanno sede né operano nella giurisdizione del vostro paese.

Facendo clic sul pulsante "Riconosci", l'utente conferma di essere entrato in questo sito web esclusivamente su sua iniziativa e non come risultato di una specifica attività di marketing. Desiderate ottenere informazioni da questo sito web che sono fornite su sollecitazione inversa in conformità con le leggi della vostra giurisdizione.

Grazie per il vostro riconoscimento!

Tenete presente che il sito web è destinato a persone che risiedono in giurisdizioni in cui l'accesso al sito web è consentito dalla legge.

Tieni presente che PU Prime e le sue entità affiliate non sono stabilite né operano nella tua giurisdizione di origine.

Facendo clic sul pulsante "Accetta", si conferma che si sta accedendo a questo sito web per iniziativa propria e non come risultato di alcuno sforzo di marketing specifico. Desideri ottenere informazioni da questo sito web che ti vengono fornite tramite una richiesta inversa in conformità con le leggi della tua giurisdizione di origine.

Grazie per il vostro riconoscimento!