Scarica l'app

-

- Piattaforme di trading

- App PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Commerciante web

- PU Sociale

-

- Condizioni di Trading

- Tipi di conto

- Spread, Costi e Swap

- Depositi e Prelievi

- Tariffe e spese

- Orari di Trading

Scarica l'app

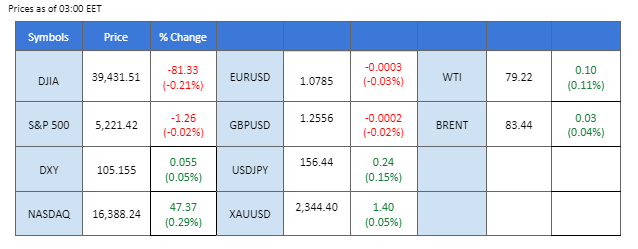

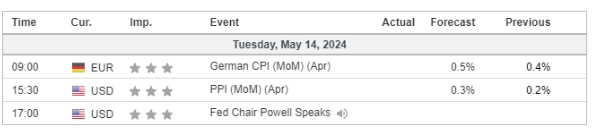

In the most recent trading session, asset classes remained largely unchanged as markets awaited key U.S. inflation data. The Producer Price Index (PPI) is set for release today, followed by the Consumer Price Index (CPI) tomorrow. These figures are critical as they could influence the Federal Reserve’s monetary policy. In the stock and bond market, both are perceived to have upside potential, bolstered by anticipations that the Federal Reserve might initiate rate cuts later this year if inflation pressures subside.

In the commodities sector, gold prices fell over 1% due to a shift in market sentiment. Hawkish remarks from Federal Reserve officials dampened the previous bullish outlook for the precious metal. Conversely, oil prices recovered from recent lows, driven by economic stimulus measures from China, including the issuance of ultra-long bonds aimed at boosting the economy. Meanwhile in Japan, the Japanese Yen is positioned to potentially strengthen as the Bank of Japan reduces its bond-buying program, leading to an increase in long-term bond yields to record levels.

Le attuali scommesse sul rialzo dei tassi 12 giugno Decisione sui tassi di interesse della Fed:

Fonte: Strumento Fedwatch del CME

0 bps (91,5%) VS -25 bps (8,5%)

(Tempo del sistema MT4)

Fonte: MQL5

DOLLARO_INDICE, H4

The Dollar Index, which measures the greenback against a basket of six major currencies, remained relatively flat but faced slight selloff as investors awaited key inflation data due later this week. Sentiment toward the dollar remains cautious as some investors seek to avoid potential volatility before the release of high-impact economic reports. Following a series of disappointing jobs reports from the US, attention has shifted to inflation figures. Any significant deviation from expectations could influence the Federal Reserve’s monetary policy stance, impacting the US Dollar.

The Dollar Index is trading lower while currently near the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 48, suggesting the index might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 105.85, 106.35

Support level: 105.05, 104.75

Gold prices retreated after breaching a strong support level, primarily due to technical corrections. The market remains uncertain ahead of the crucial US inflation report, prompting investors to avoid gold. The US Producer Price Index (PPI) data for April is set to be released on Tuesday, followed by the more closely watched Consumer Price Index (CPI) data on Wednesday. These reports are expected to provide further direction for gold prices.

Gold prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated increasing bullish momentum, while RSI is at 43, suggesting the commodity might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 2350.00, 2375.00

Support level: 2325.00, 2305.00

The GBP/USD pair extended its gains even as the Bank of England (BoE) maintains a dovish stance, with markets anticipating two to three interest rate cuts from the U.K. central bank this year, contingent on inflation approaching the target level of 2%. Meanwhile, attention is focused on the upcoming U.S. Producer Price Index (PPI) data due later today, which is expected to significantly influence the direction of the pair. A softer-than-expected PPI reading could further fuel the pound’s ascent against the dollar.

GBP/USD continues to gain with sufficient bullish momentum for the pair. The RSI has gained and climbed above the 50 level, while the MACD has broken above the zero line, suggesting that bullish momentum is gaining.

Resistance level: 1.2600, 1.2660

Support level: 1.2540, 1.2475

The EUR/USD currency pair continues to consolidate following a failed breakout attempt in the previous trading session. Market participants await key inflation data releases from the Eurozone (German and Spanish CPI) and the United States (PPI) to gauge the relative strength of the Euro and assess potential future direction for the pair.

In the last session, the pair had a false breakout from its consolidation range. The MACD continued to edge higher, while the RSI remained in the upper region, suggesting that the bullish momentum remained intact.

Livello di resistenza: 1,0865, 1,0940

Livello di supporto: 1.0700, 1.0630

The US equity market remained flat as investors struggled to find clear direction ahead of several crucial inflation reports. Among notable highlights, Tesla shares gained bullish momentum after President Joe Biden announced the potential for aggressive taxes on Chinese electric vehicles (EVs). This move could benefit Tesla by making its vehicles more competitively priced in the US market, free from the proposed tariffs.

The Dow Jones is trading higher while currently near the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 74, suggesting the index might enter overbought territory.

Resistance level: 39850.00, 41000.00

Support level: 39145.00, 37690.00

The USD/JPY pair has broken out of its week-long price consolidation range, signalling a bullish trend. However, traders should note that Japan’s long-term treasury yields have surged to record highs, potentially strengthening the Yen. Additionally, Thursday’s release of Japan’s GDP data will provide further insights into the nation’s economic condition and its implications for the Yen.

The pair has broken above from the consolidation range, suggesting a bullish bias for the pair. The RSI is on the brink of breaking into the overbought zone while the MACD staying flat above the zero line suggests the pair is trading with bullish momentum.

Livello di resistenza: 156,90, 158,35

Support level: 154.30, 153.30

Oil prices settled slightly higher on signs of an improving Chinese economy. Recent inflation data from China for April, released over the weekend, showed a sustained recovery in consumer price inflation, boosting hopes for resilient demand and economic growth following substantial monetary support from Chinese authorities. However, uncertainties surrounding a potential ceasefire deal in the Middle East persist, and investors will be closely watching these developments for further trading signals.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 53, suggesting the commodity might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 80.40, 81.90

Livello di supporto: 77,90, 75,95

Scambia forex, indici, metalli e altro ancora a spread bassi e con un'esecuzione fulminea.

Registrati per un Conto Reale PU Prime con la nostra semplice procedura.

Finanzia senza fatica il tuo conto con un'ampia gamma di canali e valute accettate.

Accedi a centinaia di strumenti a condizioni di trading leader del mercato.

Il Sito è destinato a persone residenti in giurisdizioni in cui l'accesso al Sito è consentito dalla legge.

Si prega di notare che PU Prime e le sue entità affiliate non hanno sede né operano nella giurisdizione del vostro paese.

Facendo clic sul pulsante "Riconosci", l'utente conferma di essere entrato in questo sito web esclusivamente su sua iniziativa e non come risultato di una specifica attività di marketing. Desiderate ottenere informazioni da questo sito web che sono fornite su sollecitazione inversa in conformità con le leggi della vostra giurisdizione.

Grazie per il vostro riconoscimento!

Tenete presente che il sito web è destinato a persone che risiedono in giurisdizioni in cui l'accesso al sito web è consentito dalla legge.

Tieni presente che PU Prime e le sue entità affiliate non sono stabilite né operano nella tua giurisdizione di origine.

Facendo clic sul pulsante "Accetta", si conferma che si sta accedendo a questo sito web per iniziativa propria e non come risultato di alcuno sforzo di marketing specifico. Desideri ottenere informazioni da questo sito web che ti vengono fornite tramite una richiesta inversa in conformità con le leggi della tua giurisdizione di origine.

Grazie per il vostro riconoscimento!