Scarica l'app

-

- Piattaforme di trading

- App PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Commerciante web

- PU Sociale

-

- Condizioni di Trading

- Tipi di conto

- Spread, Costi e Swap

- Depositi e Prelievi

- Tariffe e spese

- Orari di Trading

Scarica l'app

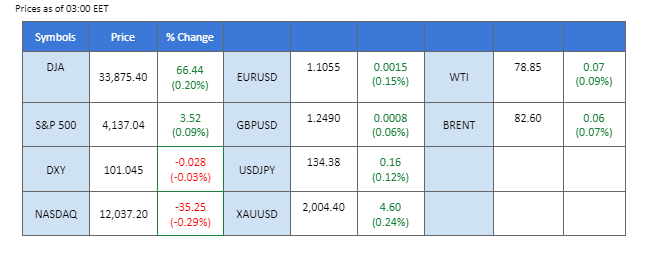

The US Dollar slipped to a one-week low as investors pondered the Federal Reserve’s monetary policy ahead of next week’s meeting, where a rate hike is expected. Uncertainty lingers, with pivotal events like the European Central Bank meetings, US Q1 GDP and PCE data releases around the corner. Meanwhile, the Japanese Yen traded lower as Governor Kazuo Ueda kept a dovish stance due to predicted weakening inflation. The Euro, however, surged following the ECB’s hawkish policy stance. Executive Board member Isabel Schnabel hinted at the possibility of a half-point rate hike at the May 4th meeting.

Le attuali scommesse sul rialzo dei tassi 3 maggio Decisione sui tassi di interesse della Fed:

Fonte: Strumento Fedwatch del CME

25 bps (16.3%) VS 50 bps (83.7%)

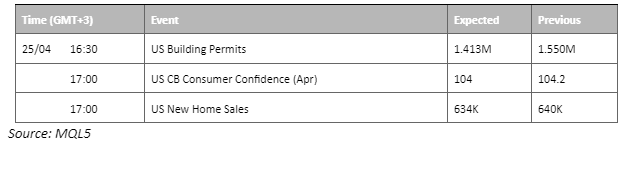

On Monday, the US Dollar suffered a blow, tumbling to a more than one-week low against a basket of major currencies in lacklustre trading, as investors continued to reassess the monetary policy stance of the Federal Reserve. With the central bank expected to implement a rate hike at next week’s policy meeting, investors anticipate the Fed may pump the brakes on its aggressive tightening policy. However, the outlook for the greenback remains uncertain considering a slew of upcoming pivotal events.

The Dollar Index is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 29, suggesting the index might enter oversold territory.

Resistance level: 101.65, 102.25

Support level: 100.85, 100.00

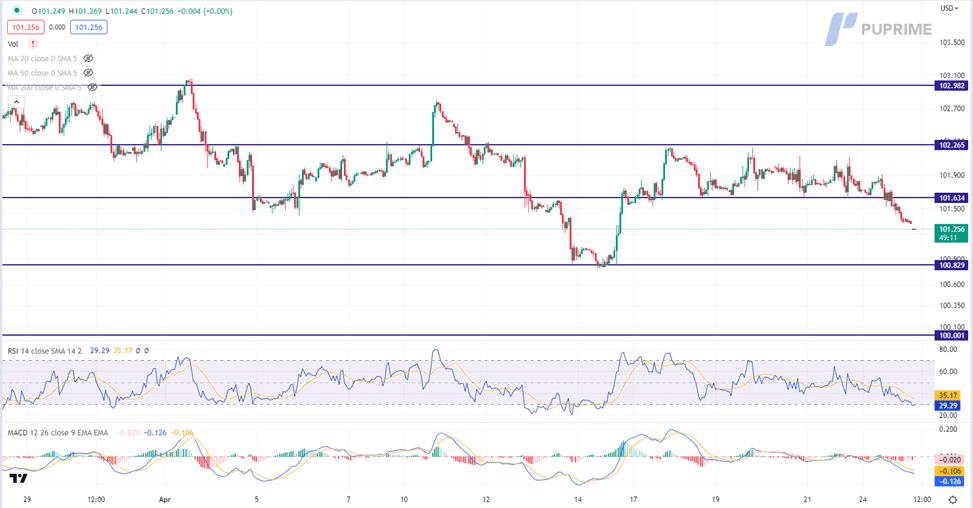

Gold prices edged higher, hovering near the key resistance level of $2,000, as both the US dollar and Treasury yields retreated after bouncing back last week from their lowest levels in a year, providing support for gold bulls. Market participants are closely monitoring economic developments and policy decisions from the Fed for further trading cues.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 65, suggesting the commodity might enter overbought territory.

Resistance level: 2000.00, 2030.00

Livello di supporto: 1975.00, 1945.00

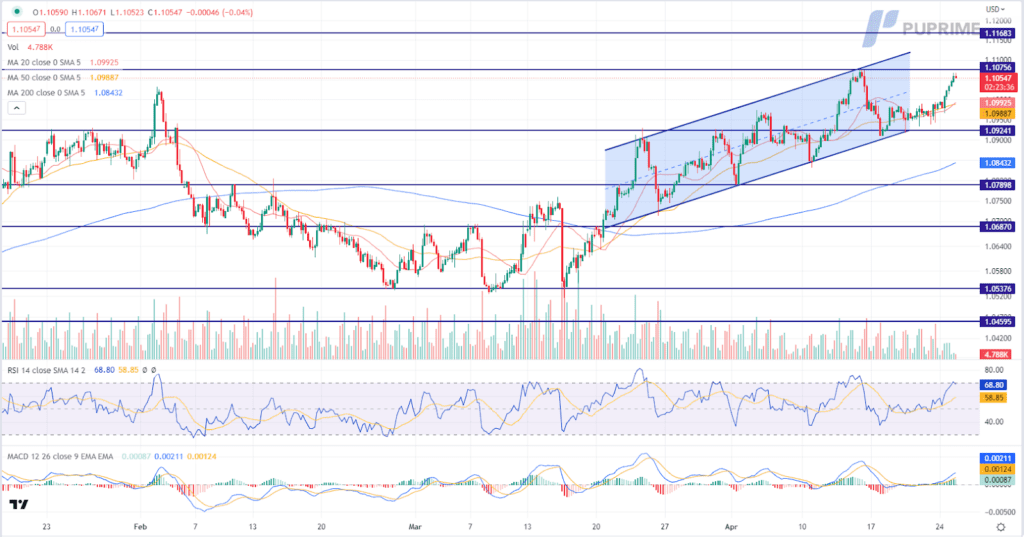

The Euro surged following the European Central Bank’s (ECB) recent adoption of a hawkish stance. This move was largely driven by Executive Board member Isabel Schnabel’s announcement that the ECB may not rule out a half-point rate hike during the upcoming May 4th meeting. The decision was motivated by the robust economic performance of the Eurozone, which has remained resilient despite ongoing banking crises.

EUR/USD is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 70, suggesting the pair might enter overbought territory.

Livello di resistenza: 1,1075, 1,1168

Livello di supporto: 1,0924, 1,0790

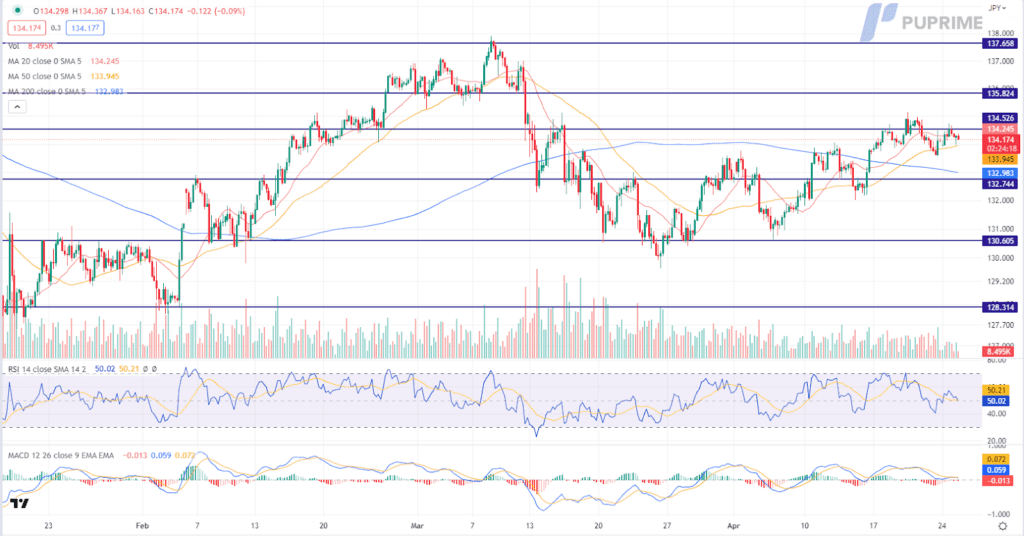

Japanese Yen continued to fall, extending its bearish trajectory, after the Bank of Japan unleashed a dovish tone. Governor Kazuo Ueda stated that there appeared to be little need to modify its monetary stimulus ahead of his first policy meeting, citing projections of a weakening inflation rate. Ueda highlighted that “inflation is expected to cool to below 2% in the second half of this fiscal year, ending in March 2024.”

USDJPY is trading higher while currently testing the resistance level. However, MACD has illustrated a neutral stance, while the RSI is near the midline, suggesting the pair might continue to consolidate in a limited range.

Resistance level: 134.55, 135.80

Support level: 132.75, 130.60

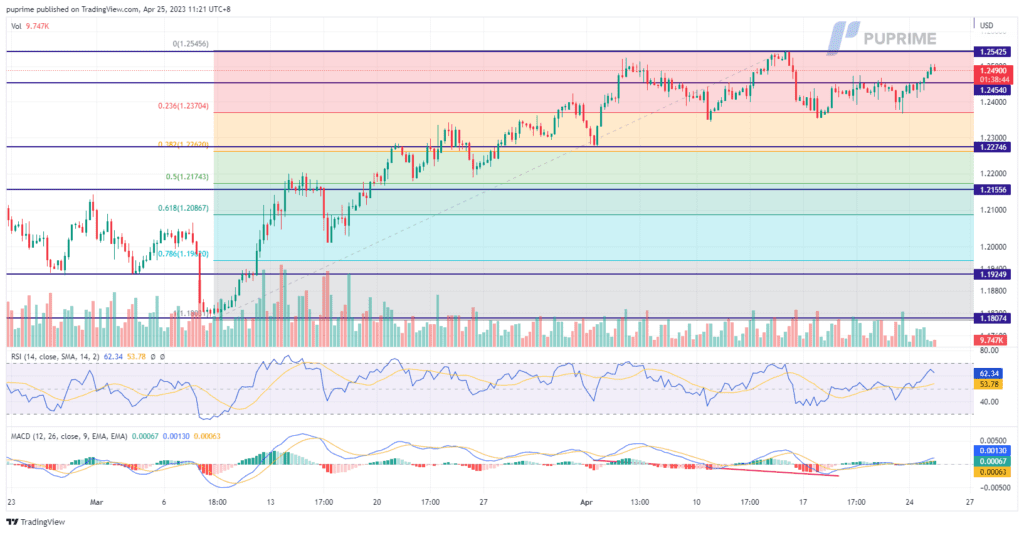

The British pound is trading near a 10-month high against the dollar as markets anticipate further tightening of policy by the Bank of England to control inflation, which was at 10.1% in March. Expectations of a 25 basis point rate hike at the BoE’s May 11 meeting have been fully priced in by traders, with economists also forecasting such a move. The pound has risen over 20% against the dollar since hitting an all-time low in September 2022.

The MACD line breaks above the zero line, indicating diminishing bearish momentum ahead. A reading of 62 on the RSI suggests that the pound’s value against the dollar is currently experiencing an increasing bullish momentum. It could indicate that the pound’s value may continue to rise against the dollar, although traders should still be cautious and monitor any potential changes in momentum.

Livello di resistenza: 1,2545, 1,2645

Support level: 1.2455, 1.2370

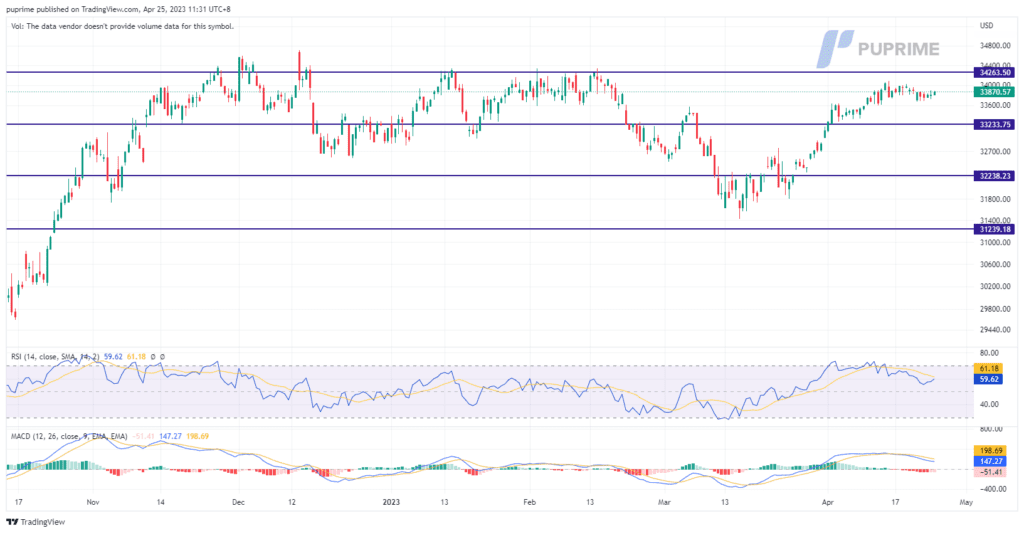

The Dow was traded flat as investors continued to brace for uncertainties ahead of heavy events. Thursday’s GDP figures and Friday’s core PCE price index and employment cost index from the Federal Reserve are closely watched. The tech sector is also focused as Microsoft, Alphabet, Amazon, and Meta Platforms announce earnings. The market capitalization of these tech giants makes their earnings reports vital for insights into the health of the US economy, with investors closely watching for indications of future market performance. Additionally, investors are closely monitoring a range of economic data releases this week, including early readings of first-quarter U.S. GDP, which are expected to show robust growth despite concerns about inflation and supply chain disruptions. The March PCE will also be closely watched for further indications of inflationary pressures.

MACD indicates the index remains trading in neutral-bullish momentum. RSI is at 59, also indicating a neutral-bullish momentum ahead.

Livello di resistenza: 34263, 35520

Livello di supporto: 33233, 32238

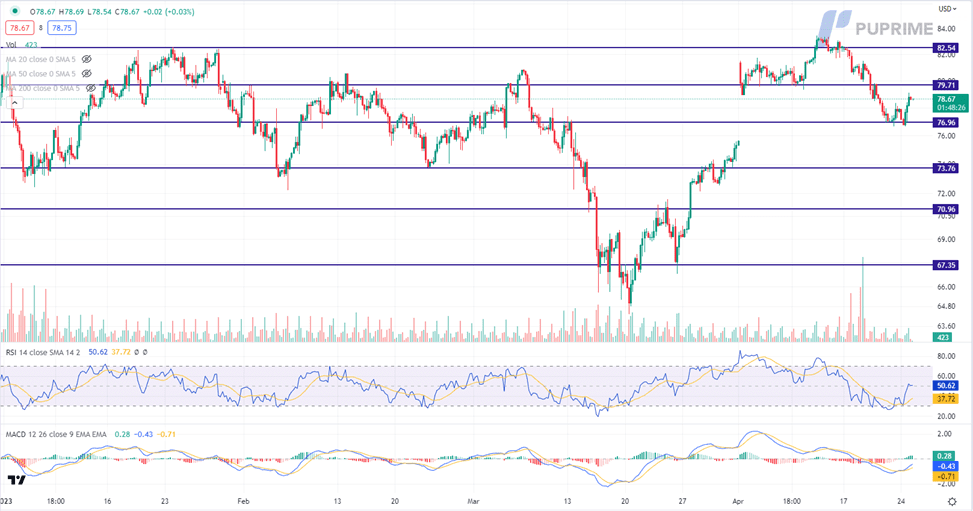

Oil prices rebounded from losses on Monday as investors grew optimistic about the demand outlook for the world’s largest oil importer, China. Despite concerns over China’s bumpy economic recovery following the Covid-19 pandemic, record volumes of oil imports in March, coupled with increased bookings for overseas travel during the upcoming May Day holiday, indicate a continued recovery in fuel demand. Additionally, the OPEC+ producer group’s planned supply cuts from May are expected to exacerbate supply tightness, providing further support for oil prices.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 51, suggesting the commodity might extend its gains toward resistance level.

Resistance level: 79.70, 82.55

Support level: 76.95, 73.75

Scambia forex, indici, metalli e altro ancora a spread bassi e con un'esecuzione fulminea.

Registrati per un Conto Reale PU Prime con la nostra semplice procedura.

Finanzia senza fatica il tuo conto con un'ampia gamma di canali e valute accettate.

Accedi a centinaia di strumenti a condizioni di trading leader del mercato.

Il Sito è destinato a persone residenti in giurisdizioni in cui l'accesso al Sito è consentito dalla legge.

Si prega di notare che PU Prime e le sue entità affiliate non hanno sede né operano nella giurisdizione del vostro paese.

Facendo clic sul pulsante "Riconosci", l'utente conferma di essere entrato in questo sito web esclusivamente su sua iniziativa e non come risultato di una specifica attività di marketing. Desiderate ottenere informazioni da questo sito web che sono fornite su sollecitazione inversa in conformità con le leggi della vostra giurisdizione.

Grazie per il vostro riconoscimento!

Tenete presente che il sito web è destinato a persone che risiedono in giurisdizioni in cui l'accesso al sito web è consentito dalla legge.

Tieni presente che PU Prime e le sue entità affiliate non sono stabilite né operano nella tua giurisdizione di origine.

Facendo clic sul pulsante "Accetta", si conferma che si sta accedendo a questo sito web per iniziativa propria e non come risultato di alcuno sforzo di marketing specifico. Desideri ottenere informazioni da questo sito web che ti vengono fornite tramite una richiesta inversa in conformità con le leggi della tua giurisdizione di origine.

Grazie per il vostro riconoscimento!