Scarica l'app

-

- Piattaforme di trading

- App PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Condizioni di Trading

- Tipi di Account

- Spread, Costi e Swap

- Depositi e Prelievi

- Tariffe e spese

- Orari di Trading

Scarica l'app

U.S. Treasury bonds are government-issued fixed-income securities valued for credit quality, income, and clarity of structure.

In periods of higher interest rates, newly issued Treasuries offer comparatively higher yields, giving investors a way to balance portfolios, manage liquidity, and benchmark alternatives such as deposits or corporate debt.

Returns come from semi-annual coupon payments and from price changes that move inversely with interest rates.

The shape of the yield curve, along with Federal Reserve policy, inflation expectations, issuance, and investor demand, guides yield levels across maturities.

Short-dated Treasury bills are sold at a discount and mature at par, so the return is the difference between purchase price and face value. Inflation-linked options include TIPS, which adjust principal with CPI, and I Bonds, which combine a fixed rate with an inflation component and carry purchase limits and holding rules.

Tax treatment varies by instrument and jurisdiction.

For trading access without owning the bond, PU Prime offers Treasury-related CFDs that let traders speculate on price movements influenced by rates, inflation, and market sentiment.

Key Points:

High-yield Treasury bonds have attracted renewed investor attention amid an uncertain market environment, as investors seek more stable returns.

Issued by the US government, these fixed-income instruments are known for their reliability and transparent structure.

When interest rates rise, the yields on newly issued Treasuries typically increase as well, creating an opportunity for investors to access more competitive returns compared to recent years.

The term “high yield” in this context refers not to increased risk, as it does with corporate bonds, but to the relatively elevated interest payments available during periods of higher interest rates.

These bonds can help balance portfolios, generate predictable income, or serve as a reference point when evaluating alternatives such as bank deposits or corporate debt.

For those looking to speculate on price movements rather than purchase bonds outright, platforms such as PU Prime provide access to Treasury-based CFDs.

These contracts for difference allow traders to take positions based on bond price fluctuations without holding the underlying security.

Understanding how these instruments work—including how yields are determined, how pricing changes with interest rates, and the influence of inflation and taxation—supports more informed decision-making in the fixed-income space.

Treasury bonds are long-term debt securities issued by the United States Department of the Treasury.

When investors purchase a Treasury bond, they are effectively lending money to the US government in exchange for regular interest payments, known as coupons, and the return of the full principal at maturity.

These bonds typically have maturities of 20 or 30 years and are part of a broader family of Treasury securities that also includes shorter-term Treasury bills and notes.

Returns from Treasury bonds come from two primary sources:

Several factors influence yields on Treasury bonds:

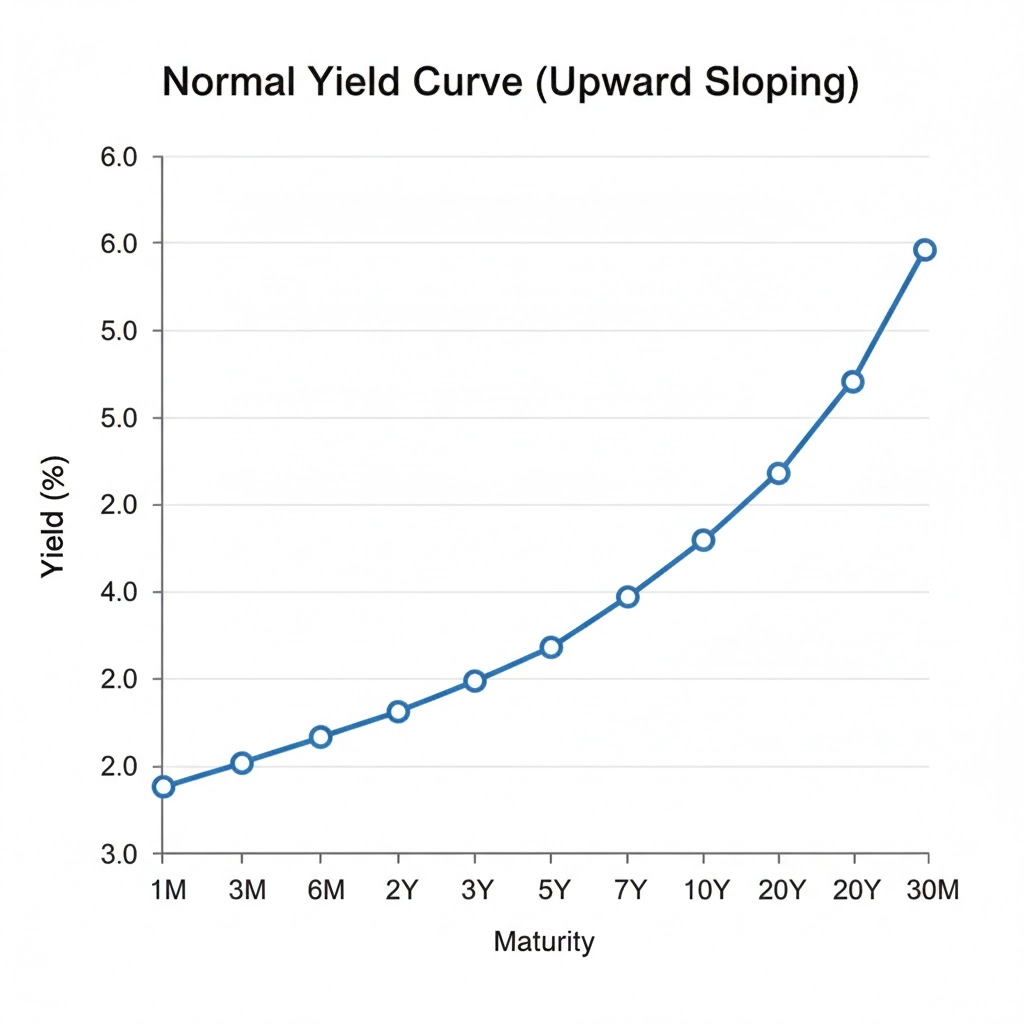

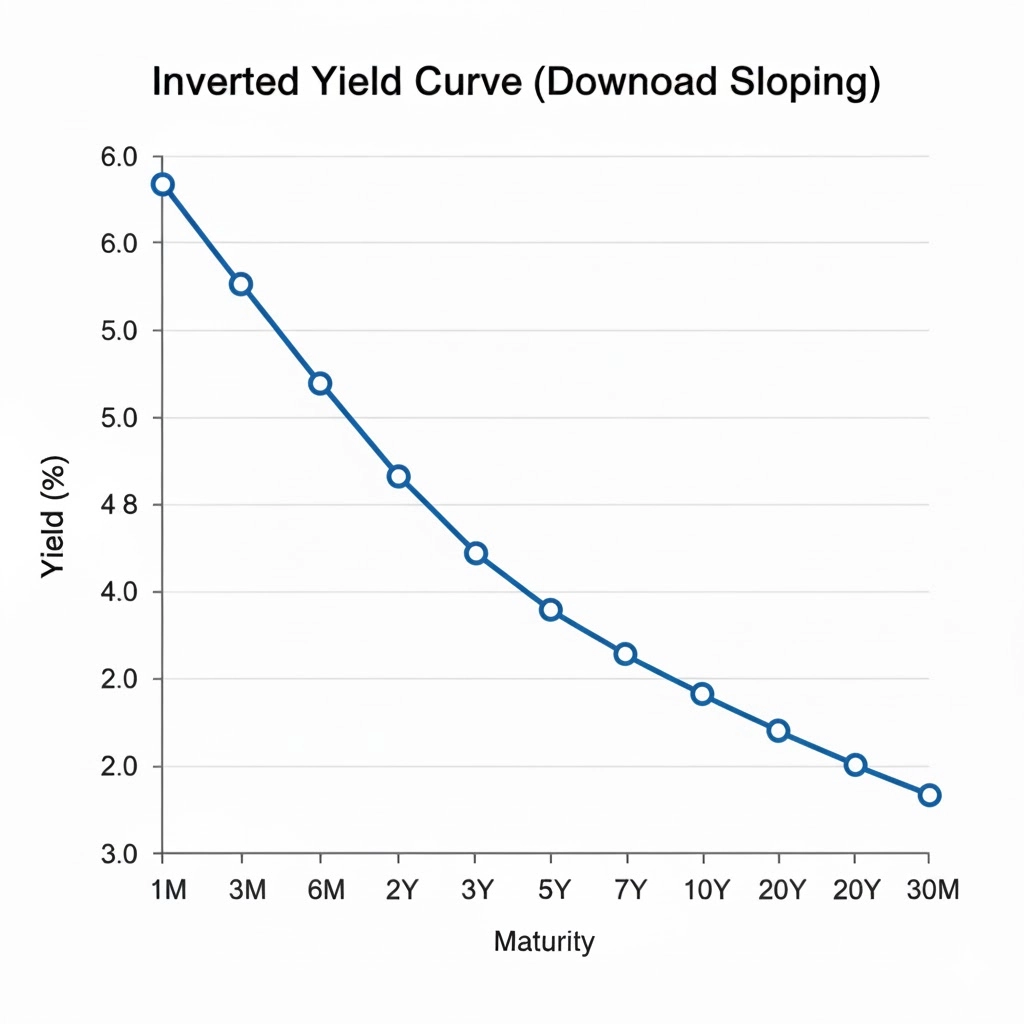

The yield curve shows the relationship between bond yields and their maturities.

A normal yield curve slopes upward, indicating that longer-term bonds offer higher yields than short-term ones.

When short-term yields exceed long-term yields, the curve inverts, often reflecting market expectations of an economic slowdown or future rate cuts.

Understanding these dynamics helps investors assess not just the return potential of Treasury bonds, but also their place in a broader portfolio strategy.

PU Prime offers access to Treasury markets via CFDs, allowing traders to speculate on price movements influenced by yield changes without directly owning the underlying bonds.

Yields on US Treasury bonds have varied widely over time, shaped by shifts in interest rate policy, inflation, and investor sentiment.

The term “high-yield Treasury bonds” typically refers to periods when newly issued bonds offer higher-than-average returns, often driven by rising interest rates or expectations of sustained inflation.

The highest yields on Treasury bonds occurred in the early 1980s, when the US Federal Reserve raised interest rates to combat soaring inflation.

At that time, 30-year Treasury bonds yielded more than 15 per cent. In contrast, yields fell to historic lows in 2020 when pandemic-related uncertainty and monetary easing pushed the 10-year yield below 1 per cent.

More recently, Treasury yields have climbed significantly from those lows.

As of early May 2025, the 10-year Treasury yield is around 4.3 per cent, while the 30-year bond yield is approaching 4.8 per cent.

These levels are considered elevated by modern standards and reflect tighter monetary conditions and persistent inflation risks.

The Treasury yield curve plots the yields of government bonds across various maturities from one month to 30 years.

It serves as a snapshot of market expectations about interest rates, inflation, and economic growth.

As of May 2025, the yield curve has begun to normalise with longer maturities, once again offering higher yields than intermediate-term bonds.

This shift reflects market views that interest rates may ease gradually while long-term inflation concerns remain.

Treasury yields are expressed as annualised percentages.

For example, a 10-year bond yielding 4.3 per cent means an investor earns that percentage per year based on the bond’s price and interest payments.

For Treasury bills, which are sold at a discount, yields are calculated based on the difference between the purchase price and the maturity value.

A Treasury bill, or T-bill, is a short-term debt instrument issued by the US government.

Unlike bonds or notes, T-bills do not pay interest in the traditional sense.

Instead, they are sold at a discount to their face value and mature at par.

The difference between the purchase price and the maturity value represents the investor’s return.

When you purchase a $1,000 T-bill, you are not paying $1,000 upfront.

Instead, you pay a lower amount and receive the full $1,000 when the bill matures.

The amount you pay depends on the prevailing yield at the time of purchase.

For example:

This return reflects the discount rate, which is calculated and quoted on an annualised basis.

The shorter the term, the smaller the dollar discount, even if the yield remains the same.

This structure makes T-bills particularly appealing to investors seeking low volatility and short-term income.

While they do not offer coupon payments, their return is known and fixed at the time of purchase.

The 6-month Treasury rate reflects the annualised yield investors receive for holding a Treasury bill with a six-month maturity.

It is closely watched by traders and investors as a short-term benchmark for government-backed returns and is influenced by monetary policy, inflation expectations, and market sentiment.

As of early May 2025, the 6-month Treasury bill is yielding approximately 4.1 per cent per annum.

This marks a significant shift from the ultra-low interest rate environment of recent years and highlights the impact of tighter monetary conditions following a period of elevated inflation.

Yields on short-term Treasuries, such as the 6-month bill, have started to moderate after peaking in 2024, in line with the US Federal Reserve’s gradual policy adjustments.

To find the most up-to-date 6-month Treasury yield, investors can refer to:

Several key elements drive the pricing of 6-month T-bills:

For those who wish to respond to changes in short-term interest rates, PU Prime’s platform offers CFD trading on Treasury instruments, including those linked to short maturities.

This allows traders to take positions based on rate expectations without holding the underlying security.

While often referred to as a “3-month Treasury bond,” this term typically describes a 3-month Treasury bill, a short-term security that offers a fixed return through discount pricing rather than periodic interest payments.

Example: Calculating the Return

Suppose the 3-month Treasury yield is currently 4.3 per cent per annum.

Here’s how that translates into an actual return:

In this case, the bill would cost approximately $989.25, and at maturity, the investor would receive the full $1,000.

The $10.75 difference represents the return over the 3-month period.

Although the return over three months is relatively modest, yields are expressed on an annual basis to allow comparisons with other financial products.

A return of 1.075 per cent over three months equates to an annualised yield of 4.3 per cent.

This makes short-term Treasuries useful for those managing liquidity or seeking a predictable, time-bound return.

T-bills do not compound unless reinvested. If the intention is to roll over the proceeds into another 3-month bill at maturity, future yields may differ.

This introduces reinvestment risk, particularly if interest rates decline during the holding period.

Traders aiming to respond quickly to changes in short-term Treasury prices can use PU Prime’s CFD offerings to take positions on 3-month Treasury bill price movements.

CFDs provide flexibility for short-term trading but do not pay interest or involve ownership of the underlying bond.

A key concept in bond investing is the inverse relationship between price and yield.

When interest rates rise, the market value of existing bonds tends to fall.

Conversely, when rates decline, bond prices usually increase.

This is because fixed coupon payments become more or less attractive depending on the current rate environment.

For example, if a bond pays 3 per cent interest but new bonds are offering 5 per cent, investors may only be willing to buy the older bond at a discounted price to match the market’s effective return.

Duration measures how sensitive a bond’s price is to changes in interest rates.

The longer the duration, the more the price may fluctuate in response to rate movements.

This is important for investors to consider when deciding how much risk they are willing to take on in a changing rate environment.

Treasury bills and certain stripped securities do not pay periodic interest. Instead, they are sold at a discount and mature at face value.

The discount rate is used to calculate the implied interest earned over the life of the instrument.

For example, buying a T-bill for $980 that matures at $1,000 implies a $20 gain, which is then annualised to express the yield.

This approach differs from coupon-bearing securities, which provide regular payments throughout the holding period.

Interest rate changes not only affect the value of bonds in long-term investment portfolios but also influence short-term trading strategies.

Traders using PU Prime’s Treasury-based CFDs can position themselves to benefit from price movements tied to rate expectations without holding the actual bond.

Price movements in CFDs are driven by the same underlying economic principles, so a solid grasp of rate dynamics remains essential.

Most US Treasury bonds and notes offer a fixed coupon rate, which is determined at issuance and paid semi-annually.

These rates reflect the returns investors can expect from holding the bond to maturity, assuming no price changes.

Not all government-issued bonds are structured the same way.

One notable example is the Series I Savings Bond, or I Bond, which includes an inflation-linked component in its interest calculation.

I Bonds are designed to protect purchasing power by combining:

Together, these components form a composite rate, which adjusts over time.

For example, if the fixed rate is 1.1 per cent and the inflation adjustment is 2.86 per cent annually, the resulting composite rate would be approximately 3.98 per cent for that period.

Unlike marketable Treasury securities, I Bonds cannot be traded.

They are purchased directly from the US Treasury and held in a personal account.

Investors are subject to a one-year minimum holding period and may face a penalty if redeemed within five years.

I Bonds are intended for individual investors and come with limits:

These limits make I Bonds useful for preserving personal savings against inflation but less suitable for institutional or large-scale investment strategies.

| Feature | Standard Treasury Bond | I Bond |

| Tradable | Yes | No |

| Interest Type | Fixed | Fixed + Inflation Adjustment |

| Purchase Method | Brokers / TreasuryDirect | TreasuryDirect only |

| Early Access | Can be sold anytime | Locked for 12 months |

| State Tax Exempt | Yes | Yes |

| Federal Tax Treatment | Taxable annually | Tax-deferred until redemption |

Treasury Inflation-Protected Securities (TIPS) are US government bonds specifically designed to help investors preserve their purchasing power.

Unlike standard fixed-rate bonds, TIPS adjust their principal value in line with changes in the Consumer Price Index (CPI).

This inflation-linking mechanism means both the amount you receive at maturity and the interest paid every six months reflect actual inflation outcomes.

TIPS pay a fixed coupon rate, but that rate is applied to a principal amount that adjusts over time.

As inflation rises, the bond’s principal increases, leading to higher interest payments.

If deflation occurs, the principal may decrease, though the US Treasury guarantees that you will receive at least the original face value when the bond matures.

Example:

A commonly used metric when comparing TIPS with standard Treasury bonds is the break-even inflation rate.

This is the difference between the yield on a conventional Treasury and the yield on a TIPS of the same maturity.

It reflects the inflation rate that would make an investor indifferent between the two.

This makes TIPS useful for investors who expect inflation to be higher than the market is currently pricing in.

TIPS are often included in portfolios as a hedge against unexpected inflation.

They are especially relevant during periods of rising consumer prices, supply shocks, or long-term fiscal uncertainty.

While they may not always outperform conventional bonds, they offer value in managing inflation risk.

TIPS can be bought directly through Treasury auctions or on the secondary market, but they are also influenced by broader interest rate movements.

For traders interested in speculating on inflation expectations or rate shifts, platforms like PU Prime offer access to Treasury-related CFDs, including those linked to TIPS.

These CFDs allow participation in market movements without owning the underlying bonds.

The US Treasury yield curve reflects the interest rates offered across different maturities, from short-term bills to long-term bonds.

As of May 2025, the curve has begun to normalise after a period of inversion, with yields gradually increasing from short to long durations.

This slight upward slope suggests that markets anticipate stable inflation and a gradual easing of short-term interest rates.

Investors seeking income or capital preservation can assess the yield curve to determine which maturities align best with their objectives and risk tolerance.

The US Federal Reserve has moved from aggressive rate hikes in 2022 and 2023 to a more balanced stance in 2025.

With inflation moderating, the central bank has initiated modest rate cuts, lowering the federal funds rate to the mid-4 per cent range.

While the pace of future adjustments remains uncertain, the current policy aims to support economic growth without reigniting inflation.

Treasury yields at all maturities continue to respond to this evolving guidance.

Several factors influence Treasury yields:

The 10-year US Treasury note is widely considered the benchmark for long-term interest rates.

It serves as a reference point for pricing various financial products, including mortgages, corporate bonds, and other government debt.

Its yield reflects investor expectations for economic growth, inflation, and central bank policy over the medium- to long-term.

Because of its liquidity and role in global markets, movements in the 10-year yield are closely watched by investors and analysts as an indicator of market sentiment.

As of May 2025, the 10-year Treasury yield is approximately 4.3 per cent.

This marks a significant shift from the ultra-low levels seen in 2020 and 2021, when yields fell below 1 per cent amid aggressive monetary easing and pandemic-related uncertainty.

Recent upward movements in the 10-year yield have been driven by:

These factors have created a more balanced environment, with longer-term yields rising in line with expectations for stable inflation and a gradual return to economic growth.

Changes in the 10-year yield can offer insights into:

For traders interested in reacting to changes in the 10-year yield, PU Prime offers CFDs on Treasury-related instruments, allowing them to speculate on price movements without owning the underlying note.

These products can be used to express views on rate changes, inflation forecasts, or broader market sentiment.

Income earned from Treasury securities, including bills, notes, and bonds, is typically considered taxable under most national tax systems.

This includes interest paid on coupon-bearing securities and gains realised from discount-priced instruments such as Treasury bills.

The timing of tax reporting may vary depending on the investor’s location and whether the bond is held directly or through an investment vehicle.

With inflation-protected instruments such as TIPS (Treasury Inflation-Protected Securities), tax treatment can be more complex.

In many jurisdictions, both the fixed interest payments and the inflation adjustments to principal are treated as income in the year they occur, even if the inflation component is not received until maturity.

Investors should be aware that this may result in taxable gains that are not immediately accessible in cash.

Some savings bonds, such as I Bonds, allow for tax deferral until the bond is redeemed or matures.

In some countries, interest earned on these instruments may also qualify for tax exemptions if used for specific purposes such as education.

These benefits and eligibility criteria vary by region and should be verified with a local tax authority or financial adviser.

Selling Treasury securities before maturity may result in a capital gain or loss, depending on the market price at the time of sale.

Tax treatment of capital gains varies across jurisdictions, with factors such as holding period, investor classification, and account type potentially affecting the outcome.

When trading Treasury-based Contracts for Difference (CFDs), the tax implications are typically different from those of holding the actual bond.

With CFDs, there are no interest payments or ownership of the underlying asset.

Profits or losses are generally based on price movements and may be taxed as capital gains, income, or trading profits depending on local laws.

As with any financial product, investors are encouraged to consult with a qualified tax professional in their country or region to fully understand the tax obligations associated with both direct bond investments and Treasury-based CFDs.

While Treasury bonds are known for their strong credit quality, they are not without risk.

Understanding the trade-offs can help investors and traders manage expectations and make more informed decisions.

The most significant risk for Treasury bondholders is interest rate risk.

When market interest rates rise, the price of existing bonds generally falls.

This can lead to unrealised losses for those who need to sell before maturity.

Longer-term bonds are more sensitive to rate changes than short-term instruments.

Standard Treasury securities provide fixed returns in nominal terms.

If inflation rises unexpectedly, the real value of those interest payments and principal repayments may decline.

While products like TIPS are designed to offset this, conventional bonds remain exposed to inflation erosion.

Investors in short-term Treasuries may face reinvestment risk.

If interest rates fall after a bond matures, reinvesting the proceeds could result in lower future returns.

This is particularly relevant for those using Treasury bills as a cash management tool.

Although TIPS adjust for inflation, in rare cases of deflation, the inflation-linked principal may decrease.

While the US Treasury guarantees to repay at least the original par value at maturity, deflation can temporarily reduce coupon payments and the bond’s market value.

Most US Treasury securities are highly liquid, but older issues that are no longer the most recently issued (“off-the-run”) may trade with slightly wider bid-ask spreads.

This can impact execution for large trades or during periods of market stress.

When investing in low-risk assets like Treasuries, there may be a trade-off in terms of lower potential returns compared to equities, real estate, or higher-yielding bonds.

This is particularly important to consider over longer time horizons or during bull markets in risk assets.

Trading Treasury-based CFDs, such as those available on PU Prime, introduces a different risk profile.

These products allow traders to speculate on price movements but do not pay interest or guarantee capital preservation.

CFD positions are subject to market volatility, leverage, and liquidity considerations, and may result in losses exceeding the initial investment.

Holding the actual bond provides benefits such as state tax exemptions and predictable cash flows. CFDs, by contrast, follow a separate tax and regulatory framework and do not confer ownership rights.

Investors should understand the differences between physical bonds and derivatives before choosing how to gain exposure.

High-yield Treasury bonds offer a way to generate steady returns from low-risk government securities, especially during periods of elevated interest rates.

Whether accessed through direct investment or by trading price movements via CFDs, they can serve a variety of roles in an investor’s portfolio — from income generation to capital preservation.

Understanding how yields work, the impact of inflation, and the risks involved helps traders and investors make more informed decisions across different market conditions.

Interested in exploring how Treasury markets react in real time?

Open a free demo account with PU Prime to practise trading Treasury-based CFDs in a risk-free environment and test your strategies using live market data.

High-yield Treasury bonds typically refer to US government bonds offering relatively higher returns due to market conditions such as rising interest rates or longer maturities.

They remain low-risk compared to corporate or high-yield (junk) bonds, as the US government backs them.

Treasury bonds generate returns through fixed interest payments (called coupons) and the return of principal at maturity.

Some, like T-bills, are sold at a discount and mature at full face value, with the difference representing the investor’s profit.

Treasury bonds are considered low risk due to their government backing, though they remain sensitive to inflation, interest rate fluctuations, and broader market conditions.

T-bills are short-term securities (typically under one year) that pay no interest but are issued at a discount.

Treasury bonds are long-term instruments (10 to 30 years) that pay fixed semi-annual interest and return full face value at maturity.

If you hold a Treasury to maturity, you receive the full face value.

If sold early in a rising rate environment, the bond’s market price may be lower than its purchase price.

Inflation can also reduce the real value of fixed payments.

PU Prime provides access to Treasury markets via Contracts for Difference (CFDs).

These allow traders to speculate on bond price movements without owning the underlying asset.

Returns depend on price changes, not on interest payments.

Yields are shaped by inflation expectations, central bank policy decisions, economic growth forecasts, and market demand for government debt.

Scambia forex, indici, Metalli e altro ancora a spread bassi e con un'esecuzione fulminea.

Registrati per un Conto Reale PU Prime con la nostra semplice procedura.

Finanzia senza fatica il tuo conto con un'ampia gamma di canali e valute accettate.

Accedi a centinaia di strumenti a condizioni di trading leader del mercato.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!