Scarica l'app

-

- Piattaforme di trading

- App PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Condizioni di Trading

- Tipi di Account

- Spread, Costi e Swap

- Depositi e Prelievi

- Tariffe e spese

- Orari di Trading

Scarica l'app

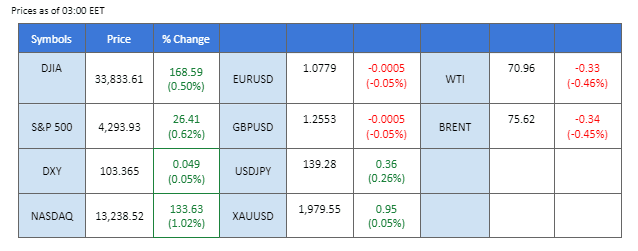

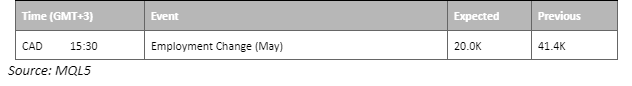

U.S. initial jobless claims recorded the highest level since October 2021, confusing the market which previously speculated the Fed might follow the footstep of RBA and BoC to raise rates next week. The equity markets were encouraged by the economic data, while the dollar has declined by 0.7% as a softer job market could prompt a more dovish monetary policy stance from the Fed. In contrast, a cheaper U.S. dollar failed to support the oil prices to trade higher, with the black gold dropping 2% last night, reflecting the fears of global growth as well as oil demand concerns. Elsewhere, the Turkish lira further weakened after a new central bank governor was appointed, and the market believed that more conventional policies will be implemented under the new leadership.

Current rate hike bets on 14th June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (66%) VS 25 bps (34%)

The US Dollar faced a significant decline following the release of disappointing data on US Initial Jobless Claims. The report revealed a substantial increase in the number of Americans filing for unemployment benefits, reaching the highest level in over a year and a half. The unexpected rise, totaling 28,000 claims, pushed the seasonally adjusted figure to 261,000, surpassing market expectations of 235,000. This negative economic indicator has raised concerns about the strength of the US labor market and the potential impact on the overall economy.

The dollar index is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 31, suggesting the index might enter oversold territory.

Resistance level: 103.45, 104.35

Support level: 102.75, 102.25

Gold prices were set for a second straight weekly gain, supported by expectations of a pause in the Federal Reserve’s rate hike cycle. Meanwhile, US Initial Jobless Claims exceed market expectations, reaching the highest level in over a year and a half. The surge in jobless claims raised concerns about the strength of the US economy. Investors will closely monitor the Federal Reserve’s decisions and economic data for further insights into the future direction of gold prices.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 55, suggesting the commodity might extend its gains toward resistance level.

Resistance level: 1980.00, 2005.00

Support level: 1940.00, 1915.00

EUR/USD increased to its highest level in June after the U.S. released its initial jobless claims data. The claim recorded its highest level since October 2021 to 261,000, reflecting that the U.S. job market is cooling down and may prompt the idea to pause rate hike from the Fed. Both the ECB and the Fed will announce its interest rate decision next week with the ECB almost certain to raise another 25 bps to its interest rate; however, market participants are still uncertain with the monetary policy that the Fed may adopt.

The EUR/USD broke above its near resistance and traded to its highest in June. The RSI rebounded while MACD crossed above the zero line, suggesting a trend reversal for the pair.

Resistance level: 1.0842, 1.0921

Support level: 1.0753, 1.0666

The Japanese Yen regained its strength, propelled by positive economic data. The latest figures from the Cabinet Office revealed an encouraging Gross Domestic Product (GDP) growth for the last quarter. Surpassing market expectations, Japan’s GDP increased from a previous reading of 0.10% to a robust 0.70%. This upward momentum suggests that the Japanese economy is gaining traction, providing a favourable backdrop for the yen’s resurgence. Investors will closely monitor these developments to gauge the potential impact on Japan’s monetary policy and its implications for currency markets.

USD/JPY is trading flat while currently near the support level. MACD has illustrated increasing bearish momentum, while RSI is at 57, suggesting the pair might extend its losses after breakout since the RSI retraced sharply from the overbought territory.

Resistance level: 142.05, 146.20

Support level: 138.50, 133.85

The Sterling traded strongly against the USD and gained nearly 1% after the U.S. initial jobless claims data was released. The piece of economic data prompted the idea that the Fed may pause its rate hike in June which is not favouring the dollar. The inflation in the U.K. has remained high and the market is expecting the BoE to continue raising interest rates; in contrast, the inflation rate in the U.S. has signs of cooling down and leaves the market uncertain if the Fed will continue to raise rates.

The cable is currently traded strongly against the USD above the uptrend support line and is heading to its strong resistance level. RSI on the brink of breaking into the overbought zone and the MACD rebounded above the zero line depicting that the cable is trading in a bullish momentum.

Resistance level: 1.2574, 1.2647

Support level: 1.2495, 1.2414

The Dow Jones Industrial Average experienced a modest climb, driven by a recovery in technology stocks following a notable decline in US Treasury yields. The pullback in yields provided a boost to the equity market, reigniting investor confidence and triggering a renewed appetite for risk. As a result, the CBOE Volatility Index, known as Wall Street’s fear gauge, dropped to a fresh post-pandemic record low. This decline in volatility underscores the prevailing optimism among global investors, as they remain undeterred by concerns and show a willingness to embrace higher-risk assets. Traders and market participants will monitor further developments to assess the sustainability of this upbeat sentiment in the equity market.

The Dow is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the index might extend its gains toward resistance level.

Resistance level: 34207, 35476

Support level: 32713, 31658

Oil prices took a sharp downturn amid a pessimistic economic outlook. The release of disappointing jobs data from the United States served as a stark reminder that the US economy continues to face stagnation. Adding to the gloom, tightening monetary policy decisions from major central banks such as the Reserve Bank of Australia and the Bank of Canada also expressed concerns, further dampening the prospects for economic growth, and dragging down the demand for oil.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 42, suggesting the commodity might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 74.20, 76.75

Support level: 70.70, 67.95

Scambia forex, indici, Metalli e altro ancora a spread bassi e con un'esecuzione fulminea.

Registrati per un Conto Reale PU Prime con la nostra semplice procedura.

Finanzia senza fatica il tuo conto con un'ampia gamma di canali e valute accettate.

Accedi a centinaia di strumenti a condizioni di trading leader del mercato.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!