Scarica l'app

-

- Piattaforme di trading

- App PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Condizioni di Trading

- Tipi di Account

- Spread, Costi e Swap

- Depositi e Prelievi

- Tariffe e spese

- Orari di Trading

Scarica l'app

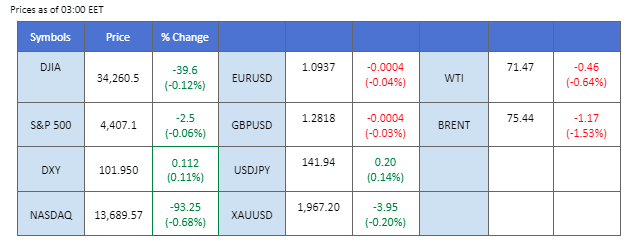

Equities in the U.S. contracted last Friday after a bullish run in the past week with Nasdaq up by more than 3%. Notably, U.S. Secretary of State Anthony Blinken’s visit to China, including meetings with top diplomats and a potential meeting with the Chinese President, is being seen as a potential catalyst for improved relations between the two nations, which could lead to a surge in equity markets. Conversely, the Japanese yen remains lacklustre against other major currencies, largely due to the Bank of Japan’s decision to maintain its ultra-loose monetary policy. Elsewhere, the Federal Reserve’s pause in interest rate hikes and the relatively weaker U.S. dollar have provided support for oil prices despite the pessimistic U.S. crude inventories data last week.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (26%) VS 25 bps (74%)

The US Dollar is expected to trade range-bound, as market catalysts from the US market remain scarce due to a holiday. However, the broader bearish trend for the US Dollar can largely be attributed to disappointing jobs data from the previous week. Investors are now closely monitoring upcoming economic data releases to assess the potential direction for the US Dollar.

The dollar index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 36, suggesting the index might be traded higher as technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 102.70, 103.30

Support level: 101.95, 100.80

Gold prices experienced a modest retreat today, driven by a technical correction, as investors navigated the subdued market conditions influenced by the US holiday. With reduced liquidity and cautious sentiment prevailing, market participants are advised to closely monitor upcoming economic data to identify potential trading signals. The release of key indicators, such as employment figures and inflation rates, can significantly impact gold prices and provide valuable insights into the prevailing economic landscape.

Gold prices are trading lower following the prior retracement from its resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 52, suggesting the commodity might extend its losses since the RSI retreated sharply from its overbought territory.

Resistance level: 1980.00, 2005.00

Support level: 1940.00, 1915.00

The Euro had an indecisive price movement on Friday after it surged by more than 1% last Thursday. The U.S. dollar remained lacklustre against most of the major pairs, supporting the Euro to trade to its monthly high. Concurrently, the ECB out-Hawked the Federal Reserve and is expecting the Euro continue to go strong against the dollar. On top of that, eurozone CPI is higher than 6%, which is still distant from its 2% inflation rate and the ECB is expected to continue to raise interest rates in the future.

EUR/USD has moved sideways since last Friday after it gained nearly 2% last week. The RSI has broken into the overbought zone while the MACD continues to surge which depicts a bullish signal for the pair.

Resistance level: 1.0947, 1.0981

Support level: 1.0891, 1.0842

The Japanese Yen slumped following the monetary decisions from the Bank of Japan. In a move aimed at bolstering a fragile economy amidst global uncertainties, the Bank of Japan has chosen to maintain its ultra-loose monetary policy. In line with market expectations, the central bank opted to keep its short-term interest rate target at -0.10% while leaving its yield curve control unchanged. Citing a likely gradual deceleration in economic growth, the Bank of Japan cautioned that the rate of increase in the consumer price index is expected to wane in the middle of fiscal 2023, reflecting diminishing effects of cost increases associated with higher import prices.

USD/JPY is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum. However, RSI is at 69, suggesting the pair might enter overbought territory.

Resistance level: 142.10, 146.20

Support level: 138.50, 133.85

The Pound Sterling continues its upward trajectory, propelled by a robust economic outlook. Recent economic data reveals a resurgent UK economy in April, driven by notable growth in the retail and creative industries sectors, which effectively counteracted a slowdown in construction and manufacturing. According to the Office for National Statistics, gross domestic product rebounded with a 0.2% increase following a 0.3% decline in March. The positive momentum has ignited speculation among market participants, who anticipate a series of interest rate hikes by the Bank of England throughout the summer to address the persistently high inflation, which is currently running over four times the targeted 2% rate.

GBP/USD is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 71, suggesting the pair might enter overbought territory.

Resistance level: 1.2980, 1.3270

Support level: 1.2645, 1.2300

The Dow has a technical retracement after but recorded a weekly gain of 1.2% in the past week. Lower CPI data as well as a pause in rate hikes from the Fed, support the equity markets in the U.S. to trade higher. On top of that, the U.S. Secretary of State is visiting China and potentially meeting with the Chinese president. A fine-tuned relationship between the 2 countries may provide a catalyst for the equity market of both countries, including the Dow to trade higher.

The Dow experienced a technical retracement last Friday but it still remained within its uptrend channel. The RSI has also retraced but is hovering above 50-level and the MACD flows flat on above zero level suggesting the bullish momentum has weakened.

Resistance level: 34840.00, 35480.00

Support level: 34200.00, 33680.00

Oil traders are showing increasing confidence in the market as they continue to accumulate long positions, driven by expectations of higher oil demand stemming from supportive policies in China. These policies are anticipated to fuel a significant uptick in oil consumption in the world’s largest oil importer. China’s commitment to boosting its crude oil imports is a key driver behind the growing bullish sentiment in the oil market. The recently announced massive crude import quota is expected to fuel robust crude oil imports in the country. As China’s stimulus measures flow through the economy, the demand for crude oil is anticipated to strengthen further.

Oil prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 62, suggesting the commodity might enter overbought territory.

Resistance level: 74.20, 76.75

Support level: 70.70, 67.20

Scambia forex, indici, Metalli e altro ancora a spread bassi e con un'esecuzione fulminea.

Registrati per un Conto Reale PU Prime con la nostra semplice procedura.

Finanzia senza fatica il tuo conto con un'ampia gamma di canali e valute accettate.

Accedi a centinaia di strumenti a condizioni di trading leader del mercato.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!