Scarica l'app

-

- Piattaforme di trading

- App PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Condizioni di Trading

- Tipi di Account

- Spread, Costi e Swap

- Depositi e Prelievi

- Tariffe e spese

- Orari di Trading

Scarica l'app

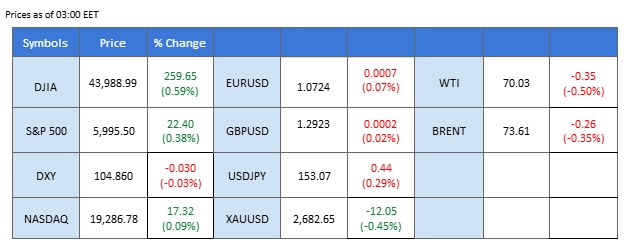

Market Summary

The U.S. dollar held steady following a recent sell-off driven by the Fed’s dovish monetary policy moves. The Fed is expected to align its actions with Trump’s policies, which could potentially elevate inflation, prompting the U.S. central bank to focus on mitigating inflationary risks. Meanwhile, the Japanese yen softened at the start of the week as markets absorbed the BoJ’s recent policy outlook, indicating the central bank may delay its next rate hike until next year.

On Wall Street, all three major indexes continued their rally, with investors encouraged by Trump’s victory and his pro-growth promises, such as tax cuts and heightened tariffs on trade partners. In commodities, safe-haven gold continued its slide for a second consecutive session amid weaker demand, while oil prices declined, pressured by disappointing Chinese economic data that may dampen demand for crude. In the financial markets, crypto took center stage as BTC surged to an all-time high above $80,000, bolstered by President Trump’s supportive stance on digital assets and the prospect of a more relaxed regulatory framework in the U.S.

Current rate hike bets on 18th December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (32.2%) VS -25 bps (67.8%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The U.S. Dollar Index, which tracks the dollar against a basket of six major currencies, has continued to advance as markets digest Trump’s win. With expectations of increased tariffs under Trump’s trade policies, the dollar is perceived as a safe-haven, with investors pivoting toward it amid concerns over global economic risk. The dollar’s resilience stems from the anticipated tariff-induced economic support that could favor the U.S. economy, although it may add strain to foreign economies. Consequently, the dollar remains in a favorable position as a globally preferred asset, with further potential upside.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 60, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 105.15, 105.65

Support level: 104.35, 103.45

Gold prices (XAU/USD) are currently trading in negative territory near $2,680 as the early Asian session opens, weighed down by a stronger dollar driven by Trump’s victory. The U.S. Dollar Index (DXY) has reached approximately 105.00, a four-month high. Speculation around the Federal Reserve potentially slowing its pace of rate cuts further strengthens the dollar and exerts downward pressure on USD-denominated gold.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 39, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 2705.00, 2790.00

Support level: 2660.00, 2607.00

The GBP/USD pair is currently trading within an ascending triangle pattern, suggesting potential breakout signals depending on the direction of the breach. Fundamentally, the British pound is under pressure following the BoE’s recent shift in monetary policy, marked by an interest rate cut last week. Meanwhile, the dollar has strengthened, buoyed by renewed confidence after Trump’s election victory, which has bolstered sentiment toward the greenback. A decisive breakout could indicate the pair’s next directional move, with fundamentals adding context to technical signals.

GBP/USD is trading in a higher-low, lower-high price pattern, giving the pair a neutral signal. Both the RSI and the MACD are also hovering in the mid-points, giving the pair a neutral signal.

Resistance level: 1.2940, 1.3040

Support level: 1.2815, 1.2680

The EUR/USD has found support near its 1.0658 level, with a potential technical rebound from this zone signalling a possible trend reversal. Recent eurozone economic indicators, including better-than-expected Retail Sales and PMI readings, have helped counterbalance the dollar’s strength, allowing the pair to stabilise at its recent low. This supportive data from the eurozone could provide the momentum needed for recovery if dollar pressures ease further.

The EUR/USD is currently struggling near its recent low level, a double-bottom price pattern suggesting a potential technical rebound for the pair. The RSI is close to the oversold zone while the MACD is edging lower, suggesting the bearish momentum is overwhelming with the pair.

Resistance level: 1.0815, 1.0890

Support level: 1.0675, 1.0622

Despite a recent 10 trillion-yuan initiative from Chinese authorities aimed at refinancing local government debt, the sentiment toward Chinese equities remains pessimistic. Concerns about China’s economic resilience persist, especially given Trump’s campaign pledge to raise tariffs on Chinese goods up to 60%. Analysts at Standard Chartered and Macquarie estimate that China’s growth could take a substantial hit, potentially shaving off up to two percentage points if these tariffs materialise. Going forward, investors will closely watch for additional Chinese stimulus measures, as they gauge their impact on both domestic and global equity markets.

The Hang Seng Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 43, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 21260.00, 22225.00

Support level: 20200.00, 18815.00

The Japanese Yen slid, pushing the USD/JPY pair above the 153.00 mark as the dollar strengthened in recent sessions. The yen faced additional pressure following the Bank of Japan’s recent policy summary, which indicated that the next rate hike may not occur until next year amid persistent global economic uncertainties. This dovish outlook has weighed on the yen, while a robust dollar continues to drive the pair higher.

The pair has found support at above its previous price consolidation range and rebounded, suggesting a potential trend reversal signal for the pair. The RSI hovers close to the 50 level while the MACD crosses the zero line, suggesting the pair’s bullish momentum is vanishing.

Resistance level: 153.80, 155.00

Support level: 152.75, 150.50

Oil prices have taken a further hit, with a gloomy Chinese economic outlook exacerbating the bearish sentiment. As the world’s largest oil importer, China’s demand remains a key driver for oil markets. However, the latest fiscal measures aimed at local government debt relief did not address core demand issues, disappointing oil investors. Deflationary pressures within China’s economy continue to weigh on oil prices, with customs data showing a sixth consecutive month of year-over-year declines in crude imports for October. Oil’s position as a growth-linked asset may remain challenged as the market navigates these headwinds.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 40, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 72.55, 74.75

Support level: 69.85, 68.45

Scambia forex, indici, Metalli e altro ancora a spread bassi e con un'esecuzione fulminea.

Registrati per un Conto Reale PU Prime con la nostra semplice procedura.

Finanzia senza fatica il tuo conto con un'ampia gamma di canali e valute accettate.

Accedi a centinaia di strumenti a condizioni di trading leader del mercato.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!