Scarica l'app

-

- Piattaforme di trading

- App PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Condizioni di Trading

- Tipi di Account

- Spread, Costi e Swap

- Depositi e Prelievi

- Tariffe e spese

- Orari di Trading

Scarica l'app

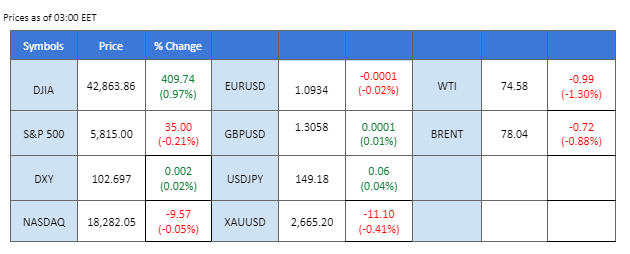

Market Summary

The Dollar Index remains volatile as mixed economic data sparks uncertainty around Federal Reserve policy. While stronger-than-expected CPI and job numbers initially boosted the dollar, a lower-than-anticipated PPI reading has led to speculation about a cautious Fed stance on rate cuts. Investors are now awaiting retail sales data and earnings reports for further insight into the U.S. economy’s trajectory.

Oil prices dipped due to profit-taking and technical corrections, though concerns over supply risks remain amid Middle East tensions. Iran’s missile strikes against Israel have raised fears of retaliatory actions potentially impacting oil infrastructure. Meanwhile, the IEA’s downward revision of oil demand forecasts—driven by slower growth in China and increased electric vehicle adoption—adds to the uncertain outlook.

Gold is slightly down as traders expect only a modest Fed rate cut, despite Middle East tensions supporting safe-haven demand. U.S. equities are upbeat, fueled by strong earnings from major banks like JPMorgan Chase and Wells Fargo. Next week, investor attention will shift to reports from Bank of America, Citigroup, and Netflix, with particular focus on consumer trends revealed by Netflix’s subscriber data.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (7%) VS -25 bps (93%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index remains in a state of flux as investors digest a mixed set of economic indicators. While the Consumer Price Index (CPI) and U.S. jobs reports came in hotter than expected, the Producer Price Index (PPI) showed a weaker reading, slipping from 0.20% to 0.10%, which dampened the dollar’s appeal. This mixed data has led to speculation that the Federal Reserve may adopt a more cautious approach to rate cuts. Market participants are now closely watching earnings reports and U.S. retail sales figures for further insight into economic health and the Fed’s potential rate moves.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 71, suggesting the index might enter overbought territory.

Resistance level: 103.25, 104.05

Support level: 102.55, 101.80

Gold prices are on track to end the week slightly lower as traders anticipate a less aggressive rate cut from the Fed. While the CPI inflation data suggests sustained price pressures, a rise in weekly jobless claims has tempered expectations for deeper rate cuts. The current market sentiment reflects an 81% likelihood of a 25-basis-point cut in November. Despite the Fed’s dovish outlook, escalating tensions in the Middle East have limited losses in the gold market, supporting its role as a haven.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 52, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 2670.00, 2690.00

Support level: 2645.00, 2630.00

The British Pound (GBP) is under significant pressure as market expectations suggest the Bank of England (BoE) may accelerate its rate-cutting cycle. The current market sentiment indicates a 90% probability of a rate cut in November. This shift in outlook follows recent remarks from BoE Governor Andrew Bailey, who hinted at the potential for more aggressive cuts if inflation data continues to trend positively. As a result, GBP/USD is likely to remain vulnerable as markets digest the possibility of a dovish pivot from the BoE.

GBP/USD is trading lower while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 39, suggesting the pair might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 1.3205, 1.3315

Support level: 1.3040, 1.2940

EUR/USD edged lower amid rising U.S. Dollar continues to exert downward pressure. Additionally, French political developments have caught traders’ attention, with the government unveiling a budget plan that includes €60 billion in spending cuts and tax increases targeting the wealthy and large corporations. This ambitious budget proposal, aimed at addressing the growing fiscal deficit, is expected to face significant challenges in the French Parliament. The lack of a majority for French Prime Minister Michel Barnier and President Macron’s allies complicates the path forward, likely delaying the final budget approval until December.

EUR/USD is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 39, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 1.0950, 1.1020

Support level: 1.0890, 1.0805

The AUD/USD pair has attracted sellers following disappointing inflation data from China. China’s Consumer Price Index (CPI) rose by 0.4% year-on-year in September, falling short of the expected 0.6%. Month-on-month CPI was flat, and the Producer Price Index (PPI) declined by 2.8% year-on-year, exceeding the anticipated drop of 2.5%. This weaker-than-expected data reflects potential deflationary pressures within China, Australia’s largest trading partner, thus impacting the Australian Dollar.

AUD/USD is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 43, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 0.6760, 0.6910

Support level: 0.6640, 0.6480

The USD/JPY pair extended gains during early Asian trading, supported by a stronger U.S. Dollar and uncertainties surrounding the Bank of Japan’s (BoJ) policy stance. Despite recent rate hikes, the Japanese Yen continues to weaken amid doubts over the BoJ’s commitment to aggressive rate increases. Furthermore, Japanese Prime Minister Shigeru Ishiba’s recent comments suggest he intends to maintain a hands-off approach concerning monetary policy, leaving decision-making solely in the BoJ’s hands. This may fuel additional volatility as markets anticipate the BoJ’s future moves.

USD/JPY is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 62, suggesting the pair might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 149.25, 150.85

Support level: 147.30, 145.85

The U.S. equity market remains optimistic as investors look forward to the earnings season. JPMorgan Chase and Wells Fargo both surpassed expectations in their earnings reports on Friday, fueling optimism. Bank of America and Citigroup are set to report next week, with Netflix releasing its earnings on Thursday. Investors will be particularly focused on Netflix’s subscriber metrics, as these could provide valuable insights into consumer spending trends amidst an evolving economic landscape.

The Dow is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 67, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 43440.00, 44900.00

Support level: 42420.00, 41400.00

Oil prices edged lower, primarily driven by profit-taking and technical corrections. Despite this short-term dip, the outlook remains mixed due to lingering concerns over potential supply disruptions from ongoing Middle East tensions. Iran’s recent missile strikes against Israel have raised fears of retaliation targeting Iranian oil infrastructure, adding to supply risks. On the demand side, the International Energy Agency (IEA) has revised its oil demand forecast downward for next year, citing slower economic growth in China and the rise of electric vehicles. These factors contribute to a complex backdrop for the oil market.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 48, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 77.00, 80.05

Support level: 72.65, 70.00

Scambia forex, indici, Metalli e altro ancora a spread bassi e con un'esecuzione fulminea.

Registrati per un Conto Reale PU Prime con la nostra semplice procedura.

Finanzia senza fatica il tuo conto con un'ampia gamma di canali e valute accettate.

Accedi a centinaia di strumenti a condizioni di trading leader del mercato.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!