Scarica l'app

-

- Piattaforme di trading

- App PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Condizioni di Trading

- Tipi di Account

- Spread, Costi e Swap

- Depositi e Prelievi

- Tariffe e spese

- Orari di Trading

Scarica l'app

Market Summary

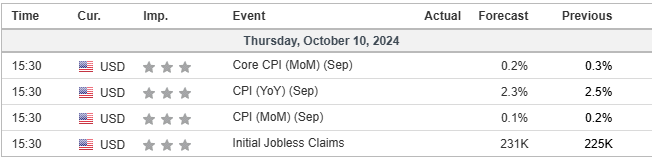

The Chinese equity market faced strong selling pressure in the last session due to disappointing economic data, while Wall Street reached another all-time high, driven by a fresh tech rally led by companies like Apple Inc, Amazon, and Netflix. However, traders should closely monitor today’s CPI reading, as a higher-than-expected result could place pressure on the equity market and further strengthen the U.S. dollar.

The FOMC meeting minutes, released yesterday, revealed that the majority of board members favoured a larger rate cut. However, the minutes also indicated that a 50 bps rate cut is unlikely, as several officials prefer a more gradual approach to monetary easing. Meanwhile, Pound Sterling remains lacklustre, with traders eyeing tomorrow’s GDP reading, which is expected to potentially boost the currency’s strength.

In the commodity market, gold prices declined to a new low for October, weighed down by a strengthening dollar, and the FOMC minutes hinting at a more hawkish stance from the Fed worsened the outlook for the precious metal. Conversely, oil prices edged marginally higher as traders await Israel’s response to attacks from Iran-backed military groups. However, a surprise increase in U.S. crude inventories by over 5 million barrels, the largest since April, could exert downward pressure on oil prices.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (7%) VS -25 bps (93%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index has extended its gains as investors await the release of crucial U.S. CPI data. Following a breakout above a significant resistance level, the dollar remains bullish, although its momentum may be tempered by the dovish tone of the latest FOMC meeting minutes. While the majority of the Monetary Policy Committee (MPC) members lean toward a 50-basis-point rate cut, recent upbeat U.S. jobs data has prompted some to consider a smaller, 25-basis-point reduction. The dollar’s trend remains uncertain, and the upcoming CPI and PPI reports are likely to provide more clarity on the Fed’s next move.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 73, suggesting the index might enter overbought territory.

Resistance level: 103.25, 104.05

Support level: 102.55, 101.80

Gold prices initially rebounded after the Fed released dovish FOMC meeting minutes but have since resumed a bearish trend as investors anticipate the U.S. CPI and PPI data later this week. With the market now largely expecting only a 25-basis-point rate cut, the dollar’s appeal has strengthened, weighing on gold prices. The mixed expectations regarding the Fed’s policy stance have left investors in a “wait-and-see” mode, with inflation data expected to be a decisive factor for gold’s near-term direction.

Gold prices are trading lower while currently testing the support level. However, MACD has illustrated increasing bullish momentum, while RSI is at 42, suggesting the commodity might enter oversold territory.

Resistance level: 2630.00, 2640.00

Support level: 2605.00, 2590.00

The Pound Sterling edged marginally lower in yesterday’s session, weighed down by the continued strength of the U.S. dollar. The dollar remained firm, especially after the release of the FOMC meeting minutes, which indicated that Fed officials prefer a gradual approach to future rate cuts, supporting the dollar’s upward momentum. Meanwhile, Pound Sterling traders are advised to closely watch the upcoming UK GDP reading, which is due tomorrow. This data will be key to assessing the strength of the Sterling and could provide insight into the U.K.’s economic health.

GBP/USD remains in a bearish trend but has found support at the near 1.3065 level. A break below this level suggests a bearish signal for the pair. The RSI remains at below 50, but the MACD is edging higher, suggesting the bearish momentum is easing.

Resistance level: 1.3140, 1.3220

Support level: 1.2985, 1.2910

The EUR/USD pair broke below its nearby support level, plunging to a two-month low, indicating a bearish bias for the pair. The euro remains under pressure due to weak economic data, which has led to growing market expectations for a more dovish approach from the ECB. Amid the strengthening of the U.S. dollar, the euro’s struggles have intensified. With the ECB’s interest rate decision due next week, anticipation of a potential rate cut is rising. Should the ECB opt for a reduction in interest rates, it will likely drive the euro even lower, further exacerbating the pair’s bearish outlook.

EUR/USD continues to record a lower-low suggesting the bearish trend remains. The RSI remain close to the oversold zone while the MACD hovering at the bottom suggests the pair remain trading with bearish momentum.

Resistance level: 1.1020, 1.1080

Support level: 1.0890, 1.0805

The Australian Dollar (AUD) has weakened amid disappointment over China’s latest stimulus announcement. The National Development and Reform Commission highlighted the challenges facing China’s economy but stopped short of introducing significant new stimulus measures. This, combined with a modest uptick in the U.S. Dollar, has put downward pressure on the AUD/USD pair. The relatively hawkish minutes from the Reserve Bank of Australia’s September meeting have offered limited support, with market sentiment being heavily influenced by concerns over China’s economic outlook.

AUD/USD is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 42, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 0.6790, 0.6910

Support level: 0.6640, 0.6480

After two consecutive sessions of sharp declines, the Hang Seng index posted a technical rebound, filling the gap from its prior uptrend. This suggests that the index may resume trading within its previous bullish trend. Meanwhile, Wall Street rallied yesterday, with the Dow Jones reaching a new all-time high, which helped boost risk-on sentiment across global markets. This positive momentum has spilled over into the Asian equity markets, providing a lift to the Hang Seng index as well. Traders may continue to monitor global risk sentiment as it plays a key role in sustaining the upward trajectory.

The Hang Seng index has broken above the gap after a technical correction, suggesting a bullish signal for the index. The RSI shows a sign of rebound, while the MACD continues to decline, suggesting that the bearish momentum is easing.

Resistance level: 21830.00, 22430.00

Support level: 20880.00, 20320.00

Oil prices rose in early Asian trade on Thursday, driven by supply concerns stemming from Middle East tensions and Hurricane Milton’s impact on Florida. Israel’s potential plans to target Iranian oil infrastructure have added to geopolitical risks, while the hurricane has increased gasoline demand in Florida as some fuel stations report shortages. With supply disruptions and demand spikes coinciding, crude prices are finding strong support, although any easing of Middle East tensions or storm impact could quickly shift sentiment.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 49, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 74.85, 77.00

Support level: 72.65, 70.00

Scambia forex, indici, Metalli e altro ancora a spread bassi e con un'esecuzione fulminea.

Registrati per un Conto Reale PU Prime con la nostra semplice procedura.

Finanzia senza fatica il tuo conto con un'ampia gamma di canali e valute accettate.

Accedi a centinaia di strumenti a condizioni di trading leader del mercato.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!