Scarica l'app

-

- Piattaforme di trading

- App PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Condizioni di Trading

- Tipi di Account

- Spread, Costi e Swap

- Depositi e Prelievi

- Tariffe e spese

- Orari di Trading

Scarica l'app

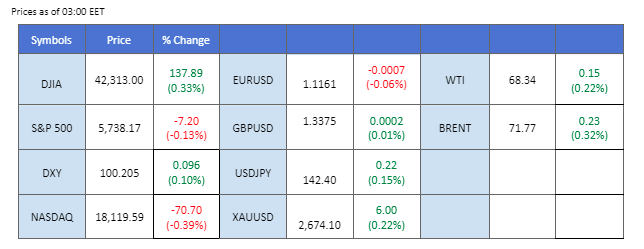

Market Summary

The financial markets were shaken by the unexpected victory in the Japan’s ruling party’s leadership race, which is set to replace the current Prime Minister of Japan. The win by Shigeru Ishiba, seen as favouring a more hawkish stance on monetary policy, led to a significant strengthening of the Japanese Yen, as his opponent, Takaichi, who was perceived as dovish, lost the race. As the Yen surged, the Nikkei 225 index suffered, reacting negatively to the stronger Yen. Concerns over the Yen carry trade also caused Wall Street to pause on Friday, with traders wary of potential volatility.

Conversely, the Chinese equity market remained resilient, buoyed by the government’s continued economic stimulus measures. The Hang Seng Index in Hong Kong reached its highest level since May 2023, indicating a bullish outlook for the index.

In the forex market, the U.S. dollar came under pressure from last Friday’s softer-than-expected Personal Consumption Expenditures (PCE) data, with the Dollar Index (DXY) struggling to hold above the critical $100 support level. The weakening dollar has propelled the AUD/USD pair to its highest level since March 2023, although it awaits a fresh catalyst to break through the current resistance.

In the commodity market, gold failed to capitalise on the softening dollar but remains trading above the $2650 mark, suggesting ongoing bullish sentiment. Meanwhile, oil prices were dampened by disappointing Chinese PMI data, which signalled a continued slowdown in the country’s economic activity.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (32%) VS -25 bps (68%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which measures the dollar’s performance against a basket of six major currencies, extended its losses following a weaker-than-expected inflation report from the US. According to the Bureau of Economic Analysis, the US Core PCE Price Index declined from 0.20% to 0.10%, missing market expectations of 0.20%. This downbeat inflation data has increased expectations of aggressive rate cuts, with the CME’s FedWatch Tool now showing a 56.7% chance of a 50-basis point cut at the Federal Reserve’s November meeting, up from 49.9% before the report.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 43, suggesting the index might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 101.80, 102.35

Support level: 100.25, 99.70

Gold prices continue to trade near a crucial resistance level, supported by the weakening US dollar and rising tensions in the Middle East. The conflict between Israel and Hezbollah escalated as Israeli airstrikes in Lebanon killed over 100 people and wounded more than 350, following the assassination of Hezbollah leader Hassan Nasrallah. These developments have raised concerns about further escalation, driving safe-haven demand for gold. Additionally, the lower-than-expected US Core PCE Price Index has fueled expectations of aggressive rate cuts, further supporting gold as a non-yielding asset.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 43, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 2665.00, 2695.00

Support level: 2640.00, 2620.00

The Pound Sterling encountered strong selling pressure near the 1.3445 mark against the U.S. dollar. A break below the 1.3350 level would indicate a potential bearish signal for the pair. The recent marginal gains were driven by the softer-than-expected U.S. PCE reading, which weakened the dollar and supported the Sterling. Looking ahead, Sterling traders will closely monitor the upcoming UK GDP reading. A better-than-expected result could provide additional strength to the Pound, potentially reversing the current selling pressure and reinforcing the currency’s bullish momentum.

The GBP/USD pair has formed a triple-top below its resistance level at 1.3445 and the bullish momentum is vanishing. The RSI has dropped out from the overbought zone while the MACD is edging lower suggest the bullish momentum is easing.

Resistance level: 1.3440, 1.3520

Support level:1.3350, 1.3285

The EUR/USD pair continues to trade within its uptrend channel, though the bullish momentum appears to be easing. Last Friday’s CPI readings from France and Spain came in lower than expected, weighing on the euro’s strength. However, the impact was mitigated by a weakening U.S. dollar, driven by an inflation gauge that fell below market expectations. While the euro faces pressure from weaker economic data, the softening of the dollar due to disappointing inflation figures is helping to keep the pair within its upward trajectory for now.

The pair was capped below the 1.1200 mark, suggesting strong selling pressure was encountered at that level. The RSI is hovering near the 50 level, while the MACD is gradually moving lower and has formed a bearish divergence, suggesting a potential trend reversal for the pair.

Resistance level: 1.1220, 1.1300

Support level: 1.1080, 1.1020

The Japanese yen strengthened after Shigeru Ishiba won the leadership contest of Japan’s ruling Liberal Democratic Party. Ishiba, a former defense minister, is known for his critical stance on past monetary stimulus and has endorsed the central bank’s rate hikes. This leadership change surprised markets, which had been expecting a victory for nationalist Sanae Takaichi, who opposed further rate hikes. As a result, the yen saw upward pressure amid shifting expectations around Japan’s monetary policy.

USD/JPY is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 39, suggesting the pair might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 144.25, 146.60

Support level: 142.25, 139.75

Hong Kong’s Hang Seng Index surged by nearly 15% after the Chinese central bank surprised markets by cutting its short-term borrowing rate. This economic stimulus from the Chinese government has propelled the equity market to its highest level since February 2023. Additionally, the index broke above its psychological resistance level at 21,000, signalling a bullish bias for the index. The move reflects optimism surrounding China’s policy support and its positive impact on the broader equity market.

The HK50 index remains bullish, suggesting a bullish bias for the pair. The RSI remains in the overbought zone, while the MACD continues to edge higher, suggesting that bullish momentum is gaining.

Resistance level: 21400.00, 21850.00

Support level: 20850.00, 20300.00

Oil prices edged higher on Monday amid fears of potential supply disruptions from the Middle East, driven by Israel’s intensified attacks on Iranian-backed forces. The possibility of a broader conflict involving Iran, a major oil producer and OPEC member, has stoked concerns in the market. Israel’s increased military action against Hezbollah and Houthi forces, both backed by Iran, has heightened the risk of supply interruptions, providing upward support to oil prices.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 53, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 68.60, 70.30

Support level: 67.15, 65.60

Scambia forex, indici, Metalli e altro ancora a spread bassi e con un'esecuzione fulminea.

Registrati per un Conto Reale PU Prime con la nostra semplice procedura.

Finanzia senza fatica il tuo conto con un'ampia gamma di canali e valute accettate.

Accedi a centinaia di strumenti a condizioni di trading leader del mercato.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!