Scarica l'app

-

- Piattaforme di trading

- App PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Condizioni di Trading

- Tipi di Account

- Spread, Costi e Swap

- Depositi e Prelievi

- Tariffe e spese

- Orari di Trading

Scarica l'app

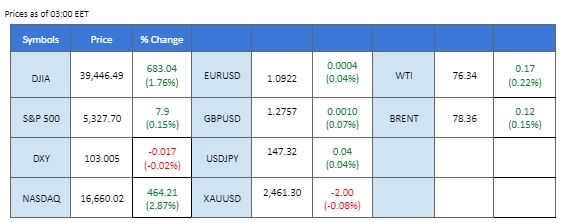

Market Summary

The financial markets reacted positively to the upbeat Initial Jobless Claims data released yesterday, which came in at 233k, lower than market expectations. This eased concerns about a weakening labour market and the heightened recession risks that emerged after last Friday’s disappointing NFP report. Wall Street benefited from the improved risk appetite, with the Nasdaq leading gains, surging by over 400 points in the last session.

However, despite the positive job data, the U.S. dollar’s strength remained muted due to ongoing market speculation about a potential September rate cut by the Federal Reserve. This dovish outlook for U.S. monetary policy has kept the dollar under pressure.

The escalating situation in the Middle East has driven demand for safe-haven assets, leading to a significant surge in gold prices. Oil prices have also edged higher as traders closely monitor developments in the region, given its critical role in global oil supply.

In the crypto market, both BTC and ETH recorded sharp gains yesterday, indicating a potential trend reversal. The Crypto Fear and Greed Index has improved significantly, reflecting increased risk appetite in the crypto market, which could continue to support higher prices for both cryptocurrencies.

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (88.5%) VS -25 bps (11.5%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The U.S. Dollar recorded a marginal gain in the last session, buoyed by the upbeat Initial Jobless Claims data released yesterday. However, the report was mixed, as the Continuous Jobless Claims came in higher than the market consensus. This mixed labour data, combined with the growing likelihood of a September rate cut by the Federal Reserve, has led to strong selling pressure on the dollar, particularly near the 103.25 level. The market’s cautious outlook on the Fed’s policy direction is keeping the dollar under pressure despite the initial positive reaction to the jobless claims report.

The Dollar Index had a long upper wick after recording a gain in the last session, suggesting strong selling pressure on the above. A breakthrough from the current resistance level suggests a solid bullish signal for the pair. The RSI is gaining while the MACD is edging toward the zero line, suggesting the bearish momentum is vanishing.

Resistance level: 103.00, 103.40

Support level: 102.65, 102.20

Gold’s recent rise above $2400, driven by Middle East tensions and constrained U.S. dollar strength, reflects the complex interplay between geopolitical risks and market expectations. The potential rate cut by the Fed and mixed job data add to the uncertainty, making gold an attractive safe-haven asset right now. This aligns with the broader trend of market participants seeking refuge in gold during times of geopolitical instability.

Gold prices edged above $2400 in the last session. If gold is able to sustain above such a level, it will be a solid trend reversal signal. The RSI has improved, while the MACD is crossing above the zero line, suggesting bullish momentum is forming.

Resistance level: 2450.00, 2480.00

Support level: 2410.00, 2380.00

The Pound Sterling (GBP) found support as global risk appetite rebounded, leading investors to shift their portfolios toward higher-risk assets. The dip-buying and risk-on sentiment sparked demand for the high-risk Pound, giving it bullish momentum.

GBP/USD is trading higher following the prior rebounded front he support level. MACD has illustrated increasing bullish momentum, while RSI is at 54, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 1.2775, 1.2855

Support level: 1.2675, 1.2615

The New Zealand Dollar (NZD) gained strength as China’s Consumer Price Index (CPI) surged more than expected, raising hopes of a recovery in the Chinese economy. According to the National Bureau of Statistics, China’s CPI rose by 0.50% year-on-year, surpassing market expectations of 0.30% and 0.20%. This stronger-than-expected CPI data has lifted Chinese proxy currencies like the NZD. Additionally, the latest New Zealand jobs report also came in better than expected, further supporting the optimistic demand for the New Zealand Dollar.

NZD/USD is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 63, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 0.6080, 0.6145

Support level: 0.6015, 0.5965

EUR/USD faced additional selling pressure, pushing it to four-day lows below the 1.0900 level. This negative price action was driven by the ongoing recovery of the US Dollar (USD) and a generally positive sentiment in global stock markets. The USD Index (DXY) continued its upward trajectory, moving above the 103.50 level, supported by a further depreciation of the Japanese yen and positive US Treasury yields.

EUR/USD is trading flat while consolidating between support and resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 54, suggesting the pair might edge higher since the RSI stays above the midline.

Resistance level: 1.0945, 1.0995

Support level: 1.0890, 1.0835

US equity markets edged higher as weekly jobless claims fell by the most in a year, alleviating concerns over a steeper economic slowdown. Wall Street indexes rebounded sharply on Thursday, recovering from some of the steep losses incurred earlier in the week amid positive earnings reports and sustained bets on interest rate cuts.

Nasdaq is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 44, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 18977.10, 20015.00

Support level: 17865.00, 17115.00

Crude oil prices have indeed been supported by several bullish factors this week, setting the stage for a potential weekly gain after a stretch of four consecutive losses. The shutdown of Libya’s largest oil production field, which has taken a significant amount of supply out of the market, is a key driver of this upward momentum. The anticipation of the Chinese CPI reading is also crucial, as it could influence demand expectations from one of the world’s largest oil consumers. If the CPI indicates stronger-than-expected economic activity in China, it could further bolster oil prices by suggesting increased demand.

Oil prices surged past their short-term resistance level at 74.30 and have been sustained above such a level, suggesting a bullish bias for oil. The RSI edged closer to the overbought zone, while the MACD broke above the zero line, suggesting bullish momentum is forming.

Resistance level: 78.55, 80.90

Support level: 75.25, 72.50

Scambia forex, indici, Metalli e altro ancora a spread bassi e con un'esecuzione fulminea.

Registrati per un Conto Reale PU Prime con la nostra semplice procedura.

Finanzia senza fatica il tuo conto con un'ampia gamma di canali e valute accettate.

Accedi a centinaia di strumenti a condizioni di trading leader del mercato.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!